Author: Yunfeng FinanceSource: Zhihu

In 1977, Lynch began managingmagellan fundAt that time, the fund size was 20 million US dollars. Thirteen years later, in 1990, the size of Magellan Fund reached 14 billion, a 700 fold increase, making it the largest fund in the world in terms of asset management at that time. There are more than one million fund holders, and almost one in every 200 Americans holds Magellan Fund. Magellan's investment performance also ranks first, with an average annual compound interest rate of 29% over 13 years.

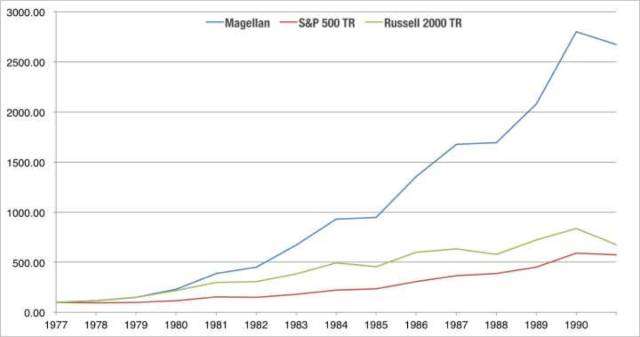

Assuming that on January 1, 1977, you invested $100 in Magellan Fund, S&P 500 Index (representing large cap stocks)Russell 2000 IndexBy the end of 1990, the return curves of the three represented small cap stocks were as follows:

Source: wikipedia

The conclusion is:

Investing in the S&P 500 will increase your money by 5.73 times;

Investing in Russell 2000 will increase your money by 6.74 times *;

Investing in Magellan Fund will increase your money by 26.7 times.

(* Note: Since Russell 2000 started at the end of 1978, we assume the returns for the years 1977 and 1978 to be the same as Magellan's.)

It can be seen that during these 13 years, Magellan has simultaneously outperformed both large cap and small cap stocks. People refer to the Magellan Fund under Lynch's leadership as the 'best performing mutual fund in the world'

Preface: Institutions have investment limitations

In Peter Lynch's view, professional investors have to diversify their investments into many stocks.Amateur investors can concentrate on investing in a small number of stocks.If you can't find good stocks for a while, amateur investors can alsoEmpty positions at any time, holding cash and waiting for opportunities。

Institutional investors do not have such freedom. Institutional investors have to announce their investment performance every quarter, constantly facing competition and comparison with peers, as well as enormous pressure from customer redemptions. Amateur investors can achieve higher returns than institutional investors by carefully selecting a few stocks that they are familiar with, focusing on a few stocks, and doing their homework.

However, the problem is that for amateur investors, these are easier said than done. Lynch in his own works《Beating the Street》In addition to the many proposals presented in Peter Lynch's Successful Investing, we can summarize them into three points to illustrate the three tastes of this master's investment:Invest in what you know; Firmly hold; Do your homework well.

Peter Lynch has a famous saying about stock selection,

Stock selection is both a science and an art, but overemphasizing any aspect of it can be very dangerousWe can easily understand that stock selection is a science, such as using quantitative tools, statistical tools, and understanding and applying data in financial reports to make investment decisions. For example: 1. The company's main business; 2. Profit from main business, return on equity, and profit growth rate; 3. Price to earnings ratiop/b ratioWhether it is reasonable, etc.

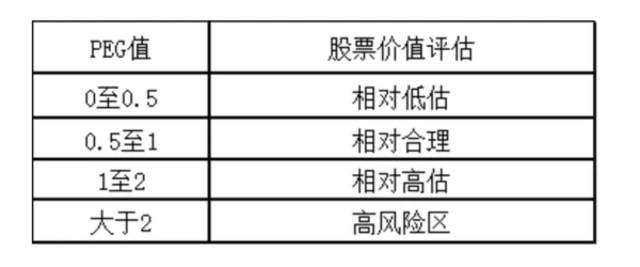

Including Lynch's judgment on whether stock prices are reasonable, there is aUnique Secret - PEG IndicatorThat is, the price to earnings ratio (P/E) divided by the growth rate of corporate profits. PEG is a method used by Peter Lynch to evaluate growth companies, which can generally be divided into four categories:

For those who have been very popular recentlyGrowth industries such as electric vehicles, new materials, and artificial intelligenceSpeaking of which, PEG can be said to be a very meaningful indicator for reference.

However, we also know that data is only a quantitative representation of a thing's past situation. Finding the direction of future changes from past changes not only has limitations, but may also have issues such as data mining bias. Being too superstitious about data often leads to the investment process gradually deviating from reality, ignoring many important details, and ultimately resulting in failure(The Story of Quantitative Strategy and the Master of Quantitative Strategy)。

The other extreme is to treat stock selection entirely as an art, with investors relying too much on intuition to make investment decisions and lacking sufficient research and investigation. Without carefully reading the report, one may not even be clear about the core business of the company they are buying stocks from, and may only rely on news or technical analysis lines such as K-lines, MACD, KDJ to buy and sell stocks. This intuitive "artistic" behavior is even more terrifying, but it is also a problem for many amateur investors.

Amateur investors can refer to Peter Lynch's famous quote -Never buy any stocks that cannot describe the company's business clearly with a pen.

In other words, it is important to ensure a very clear understanding of the company's business model. If you buy this stock, you must be able to describe the reason for buying it clearly and concisely.

Peter Lynch once conducted a famous experiment. Under the guidance of the teacher, all the students in the first grade of a middle school are investing in stocks.

Lynch requires these students to construct investment portfolios according to the following principles: each portfolio should be diversified among at least 10 companies, and one or two of them should provide fairly good dividends. Before students decide to choose a stock, they must be able toClearly explain what this company's business is aboutSo many students choose Disney, Kellog (food) and Wal Mart. The reason they gave is that these brands are ubiquitous in their lives.

The experiment lasted for two years (January 1, 1990 to December 31, 1991), during which the S&P 500 had a return rate of 26%, while the students' investment portfolios had a high return rate of 69.6%. Only two stocks experienced a decline, with the most profitable stock rising by over 300%! This experiment proves that there is no need for a specialized computer stock market quotation systemWharton School With an MBA degree, seventh grade students can do better than professional investors.

We often hear a saying, 'Art comes from life, higher than life.' In terms of stock selection, we can also say, 'Bull stocks come from life, higher than life.'.

Lynch discovered an investment technique, which is to ask yourself before buying a stockDo you like their products and approve of them。

Peter Lynch's secret to choosing consumer industry bull stocks lies inShopping。

Once he went shopping and saw the children in Toy Story City playing happily and lingering, he knew it would be a bull market. As expected, the result was,Toys R USThe stock price has risen from 25 cents to 36 dollars, a 144 fold increase.

The catering industry stocks are the same. In the 1960s in the United States, whether it was Golden Arches McDonald's or KFC, standardized food and beverage companies found successful products and models, quickly replicating and expanding. Investing in these two companies at that time could yield returns of basically 200 times.

The threshold for investment art that originates from life and is higher than life is not high. For amateur investors, perhaps their office is not on Wall Street, there is no professional Bloomberg machine in the office, and there is no weekly subscription to the Financial Times. However, these amateur investors have many advantages that institutional investors find difficult to obtain.

For exampleSome amateur investors work in the chemical industry and are able to learn about changes in the industry earlier than institutional investors.They were the first to know that there was a shortage of chlorine,Corrosive agentOut of stock. They can know inventory and sales at the first time. This has a natural advantage that institutional investors find difficult to match in estimating a company's profits.

Of course, even if the employer is not a listed company, it doesn't matter. The most important thing is still forObservation and Grasping of Business OpportunitiesLynch said that there is a firefighter in Wilbur Ray, Massachusetts who knows very little about the stock market. But he found that two companies in town were constantly expanding their factories, so he invested $1000 in their stocks every year for five consecutive years, and as a result, became a millionaire.

What everyone knows is bound to be limited.Learn from others' strengths and draw on their cognitionIt will make investment easier. For example, a friend of Lynch bought stocks of a disk drive company through technical analysis, while his wife spent a lot of money on a brand of clothing. This friend thinks his wife is really a spendthrift, she knows how to buy and sell all day long. In the eyes of the wife, the husband is the real spendthrift, and the stocks he buys never make money.

As a result, Lynch's friend's stock fell by half. At the same time, the stock price of the clothing company that his wife bought, called Limited, has increased 20 times. This clothing company is truly a big bull. If this friend had bought clothes with his wife and bought stocks, he would have made a fortune long ago. It can even be said that women are the best retail industry researchers, and children are born game and education industry researchers.

So, personal cognition has limitations, and we need to frequently observe the people around us and understand their thoughts in order to broaden our thinking and better find the best stocks.

Stock selection cannot be simplified into a simple formula or trick. There is no such thing as a stock selection formula or trick that is as effective as simply following a gourd or gourd. Stock selection is both a science and an art, but overemphasizing any aspect of it is very dangerousOnce Lynch discovers bull stocks, he will hold them for the long termFor example, Chrysler automobiles. In the early 1980s, due to the downturn in the automotive industry, the stock market was pessimistic about automotive stocks, and the entire Wall Street believed that the third largest automaker in the United States wasChryslerGoing bankrupt soon. At this time, Chrysler's stock price was only $2, but Lynch was not affected by the pessimistic market sentiment and personally conducted research on the automotive industry.

He first conducted research on Ford and found that not only is Ford good, but Chrysler's financial situation is also better, with over $1 billion in cash assets. This alone is enough to shatter Wall Street's prediction that Chrysler would go bankrupt. With further investigation, Lynch found that Chrysler products sell well and are full of vitality in development and innovation. In the spring and summer of 1982, he made a firm judgment and exceeded the maximum investment scale allowed by regulations, continuously buying Chrysler and making it his largest holding stock.

Many peers say that Lynch has gone crazy and invested in a company on the brink of bankruptcy in a struggling industry. At this moment, Lynch can be described as' everyone is drunk, but I wake up alone '. He believes that the automotive industry is a cyclical industry, and people are not optimistic about it, making already profitable automotive stocks very cheap. So he not only heavily invested in Chrysler, but also purchased car stocks such as Ford and Volvo.

In 1984, Lynch left Ford andkleistTwo stocks each earned over $100 million in profits, with Volvo earning $79 million. The lucrative returns from automotive stocks instantly boosted the performance of Magellan Fund, standing out from the crowd.

In our country, there is also an investor who focuses on collecting low-level information——Dong BaozhenDong Baozhen, the fund manager of Wujitai, has been heavily invested in Maotai since 2010 and has repeatedly publicly expressed her optimism about Maotai. However, in 2014, Maotai liquor dropped to 83.77 yuan. Not only has the floating profit scale of the fund he manages decreased by half, but his optimistic view on Maotai has also been questioned by multiple parties. Scammers, fools, clowns, shameless guys "- cursed everywhere; Why not stop loss? Why not sell "- constantly questioned.

Even worse, Dong Baozhen lost because she had previously bet with someone that Maotai's market value would not fall below 150 billion yuan, fulfilling her promise of "running naked if Maotai falls below 150 billion yuan".

As an investor, the saddest thing is to lose all your pants and dignity.

Dong Baozhen gave up her dignity, but still did not give up Maotai. At the end of 2013, he went to Maotai's transit warehouse located in the suburbs of Beijing to chat with the warehouse security and learn about the pick-up situation; In early 2014, it arrived againKweichow Moutai TownStationed next to the women's restroom in Maotai packaging workshop, caught the gap between employees using the restroom and chatted with the workers in the packaging workshop to understand the shipment volume. Soon he found that the sales volume of Moutai exceeded that of any Baijiu, and even exceeded that of Erguotou.

When everyone thought it was the darkest moment, only Dong Baozhen saw the light. He believed that the demand for Maotai was still strong, so he insisted on holding it and even searched for money to buy Maotai at a low price. In the end, it witnessed the huge growth of Maotai's market value from falling below 150 billion to over 800 billion today.

Investing in stocks is like finding a partner, all for the purpose of being together for a long time. No one is looking for a partner for divorce. Therefore, if you make a wise choice from the beginning, stick to it and don't give up easily.

When you choose a good stock, time is the biggest trend. If you choose a problematic stock, time is the biggest enemyWhether investing in what one knows or firmly holding, investors essentially need to do their homework.Stock investment is already an information war, whoever has more information and effectively processes more information has more possibilities to overcome the market.

Peter Lynch has a great say in this regard. See how he does his homework well.

Peter Lynch's daily life - working away from home at 6am and returning home at 7pm, spending time reading on the way; Lunch time is usually used for negotiations with company management; Pay attention to your favorite company when shopping with your family; When on vacation, if the company is close, they will always go to conduct research.

Lynch answered a TV host in 1982 about what he wasThe Secret to SuccessI visit over 200 companies and read 700 annual reports every year, "said Shi

This number further intensified: in 1980, he visited 214 listed companies, in 1982, he visited 330 listed companies, in 1983, he visited 489, in 1984, he visited 411, in 1985, he visited 463, and in 1986, he visited 570. Based on this speed, even with weekends and holidays included, he visits an average of two listed companies every day.

The Magellan Fund belongs toFuda CompanyWe will arrange for fund managers and senior executives of the superior company to have lunch together, sometimes dinner and afternoon tea. Lynch has developed a habit of regular communication: communicate with representatives of each major industry at least once every month to avoid missing the latest developments in that industry.

These pieces of information are neither information that only a few people know, nor information that cannot be leaked. However, by chatting with the executives of the superior company, one can gain a clearer understanding of the industry, and even the opportunities and challenges of the company.

Most people do not easily come into frequent contact with executives of listed companies. But Lynch said that anyone who comes into contact with workers in a certain industry, whether they are suppliers or salespeople, will always know or obtain relevant information about the industry.

For example, a security equipment salesperson or equipment supplier has a firsthand experience of whether the equipment is easy to sell, the market situation, and the upstream and downstream status of the industry chain. Communicating with them often allows for a faster understanding of changes happening in the industry than sitting in an office flipping through research reports.

If you don't conduct research and careful fundamental analysis on listed companies yourself, then having more stock software and information service systems is uselessAfter 20 years of marriage, Lynch only spent two holidays. "I went to Japan and spent 5 days inspecting the company; I met in Hong KongCarolineWe stayed in China for about two or three days. Then I inspected companies in Bangkok and went sightseeing there. Then I flew to England and inspected the company there for three or four days. That was a wonderful time

Of course, we cannot guarantee that his wife Caroline thinks the same way.

Finally, please include a self statement by Peter Lynch

On May 31, 1990, with a click, I turned off the securities market quotation machine in front of me and walked out of the office of Magellan Fund. I have been working here for a full 13 years, during which I have bought over 15000 stocks. Although the scale of the Magellan Fund I manage is equivalent to the gross domestic product of the entire country of Ecuador, which has brought me honor and glory, it has also cost me a personal life. I cannot have the happy time to be with my family often, nor can I enjoy the joy of watching my children grow up day by day. The children grow up and change so quickly, one thing every week, almost every weekend they have to introduce themselves to me, so that my dad, who is usually busy with investments but doesn't care about the family, can recognize who is who. When you start mixing the stock abbreviations of companies like Freddie Mac, Sallie Mae, and Fannie Mae with the names of your children at home, and when you can remember 2000 stock codes but can't remember the birthdays of a few children at home, you may have become a workaholic, deeply immersed in work and unable to extricate yourself. In 1989, it turned out that what happened in 1987Great CrashIt has long been a thing of the past, and now the stock market is moving steadily again. My wife, as well as daughters Mary, Anne, and Beth, held a birthday party to celebrate my 46th birthday. Halfway through the birthday party, my heart suddenly shook. I suddenly remembered that my father passed away when he was 46 years old. When you realize that you have lived longer than your parents, you will feel from the bottom of your heart that you, like them, are also going to leave this world. You are just beginning to realize that the time you can live is very short, while the time you will die afterwards will be incredibly long. You start to reflect on why you didn't know how to cherish precious life time before, and didn't spend more time with your children to participate in school sports competitions, go skiing, and watch rugby matches. You will remind yourself not to be a workaholic anymore. Because no one on their deathbed would say, 'I truly regret not investing more time in work!'The purpose of investment is for a better life. After 13 years at the helm of Magellan Fund, Peter Lynch ultimately chose to leave and become an amateur investor, returning to life as it was.