Bank of Japan Governor Kazuo Ueda held a monetary policy press conference, and European Central Bank President Lagarde delivered a speech.

stock market

The S&P 500 index of the US stock market rose to a record closing high on Thursday, as investors weighed mixed corporate earnings and digested President Trump's comments, including calls for lower interest rates and oil prices.

At the World Economic Forum held in Davos, Switzerland, Trump called on the Organization of the Petroleum Exporting Countries (OPEC) to lower oil prices, requested central banks to lower interest rates, and warned global business leaders that if products are produced anywhere outside the United States, they will face tariffs.

Lindsey Bell, Chief Strategist at 248 Ventures, said that although investors have been cautiously monitoring Trump's remarks about tariffs, they "like the idea of lower interest rates and lower oil prices. Overall, the more the market knows about Trump's policies, the more optimistic it becomes. We are seeing a reflection of this optimism

However, investors have been concerned that tariffs may increase inflationary pressures and slow down the pace of the Federal Reserve's interest rate cuts. It is expected that the Federal Reserve will keep interest rates unchanged at its first policy meeting of the year next week.

Peter Tuz, President of Chase Investment Counsel, an investment advisory firm, stated that it is expected that the Federal Reserve will determine interest rates based on economic data rather than presidential requests.

Tuz said about Trump's remarks on interest rates, "I don't think the Federal Reserve will pay too much attention to this. They are looking at the data, and they will make decisions based on what they see

Tuz believes that the trend of the US stock market on Thursday is a mixed reaction to the financial report and the new policies of the Trump administration.

The three major stock indexes on Wall Street have all risen for the fourth consecutive trading day. The 11 sectors of the S&P 500 index all closed up, with mixed gains and losses in previous trading. The healthcare sector saw the largest increase, rising by approximately 1.35%, followed by the industrial sector with a rise of 0.96%.

In terms of economic data, the report from the Ministry of Labor shows that the number of unemployment claims received in a week was 223000, with an expected 220000.

In terms of financial reports, GE Aerospace's stock price rose by 6.6%, after the company expected higher than expected profits in 2025; Elevance, a healthcare insurance company, saw its stock price rise by 2.7% after its fourth quarter profit exceeded expectations.

King City

Spot gold rose on Thursday as the US dollar weakened after President Trump called for lower interest rates, and market attention remains focused on the broad impact of his policies. Spot gold rose 0.1% to $2753.19 per ounce. On Wednesday, gold prices hit a three-month high, falling $26.72 short of the record high of $2790.15 set in October. US futures closed 0.2% lower, with a settlement price of $2765.

Daniel Pavilonis, Senior Market Strategist at RJO Futures, said, "Part of the reason is the US dollar, which rose this morning and was then sold off, pushing gold out of its low. Today's trend only recognizes the direction of the White House. I think some of the volatility is due to this expectation

During his speech at the World Economic Forum, Trump emphasized his commitment to reversing inflation and announced his desire for an immediate interest rate cut. He also urged other countries to take similar measures to address global economic challenges.

However, according to the CME FedWatch Tool, traders believe that the likelihood of the Federal Reserve keeping interest rates unchanged at its meeting on January 28-29 is 99.5%.

The uncertainty of Trump's future policies has prompted market participants to flock to safe haven assets such as gold to hedge against volatility.

Spot silver fell 1.1% to $30.45 per ounce; Platinum fell 0.2% to $943.84. Palladium rose 1.3% to $990.31.

Oil market

Oil prices fell by 1% on Thursday, following US President Trump's speech at the World Economic Forum urging Saudi Arabia and OPEC to lower oil costs. The uncertainty of how Trump's proposed tariffs and energy policies will affect global economic growth and energy demand has also dragged down oil prices. Brent crude oil futures closed 0.9% lower at $78.29 per barrel. US crude oil closed down 1.09% at $74.62.

During his speech at the World Economic Forum in Davos, Switzerland, Trump stated that he would demand Saudi Arabia and OPEC to reduce oil costs, which subsequently led to a decline in oil prices. Clay Seigle, Senior Researcher for Energy Security at the Center for Strategic and International Studies (CSIS), said, "Trump's call to lower oil prices will naturally be welcomed by consumers and businesses, but the US oil industry and other global suppliers are cautious about it

He added that the energy industry has been calling for increased investment in global oil and gas projects, but the decline in oil prices may raise concerns about the economic viability of new projects.

The US Energy Information Administration (EIA) announced on Thursday that despite a slowdown in refining activities, US crude oil inventories fell to their lowest level since March 2022 last week. But the decline was smaller than analysts' expectations. EIA stated that distillate inventories have also decreased, while gasoline inventories have increased.

currencies

The US dollar fell slightly in volatile trading on Thursday, following President Trump's call for lower interest rates but no clear statement on tariffs. Investors are waiting for a new round of policy announcements from global central banks.

The US dollar fell more than 1% this week, mainly due to a significant drop on Monday as the widely expected tariff measures announced by Trump after his inauguration failed to materialize. In the following trading days, the US dollar only fluctuated slightly.

The US dollar fluctuated between gains and losses during the day. During his speech to global business and political leaders in Davos, Switzerland, Trump called for a global interest rate cut and warned that they would face tariffs if they produced products anywhere outside the United States.

Despite frequent mentions of tariffs, Trump once again refused to disclose the specific details of his intention to impose tariffs. Sonora Wealth Group's investment advisor David Eng said, 'We don't have any truly certain information, so until we get a clear answer, we will continue to see more volatility. The market seems more focused on interest rate cuts and whether there will be further signs of them.'.

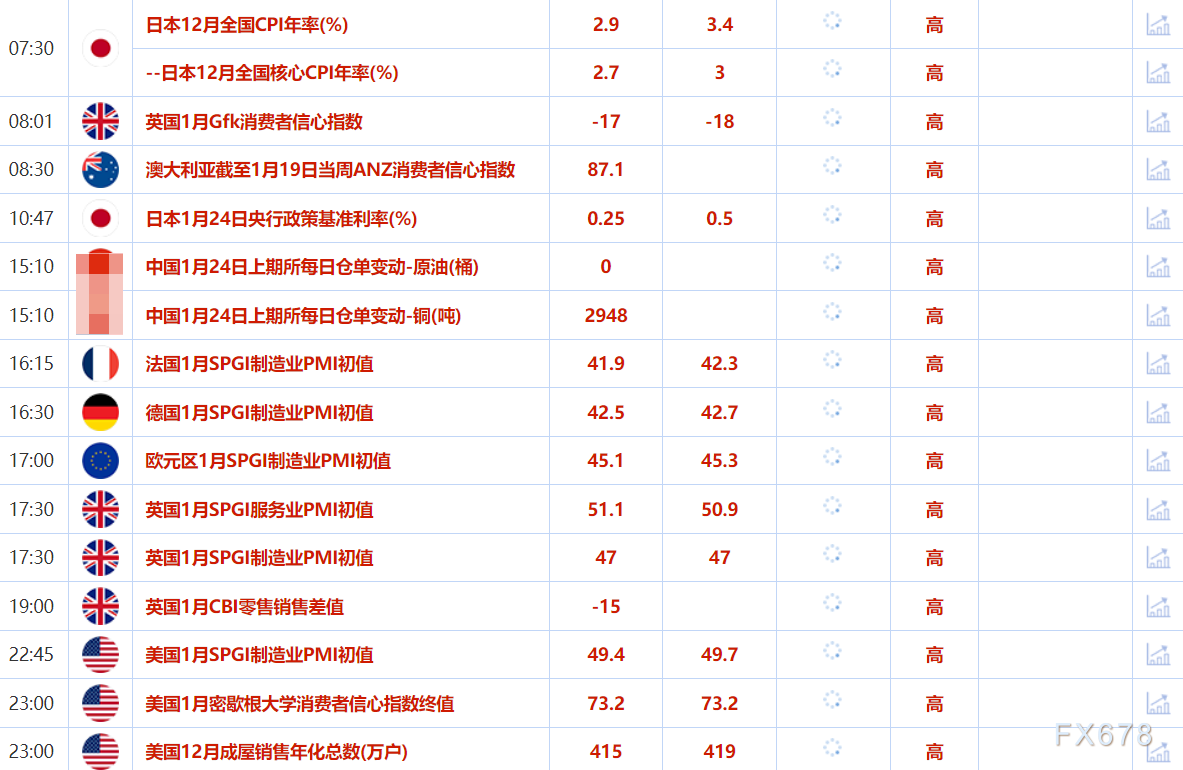

Investors are waiting for global central banks to make a series of policy decisions next week. It is widely expected that the Bank of Japan will raise interest rates at the end of its two-day meeting on Friday. The Federal Reserve and the European Central Bank will make interest rate decisions next Wednesday and Thursday, respectively.

The market believes that the possibility of the European Central Bank cutting interest rates at the meeting is close to 96%, and recent statements from the central bank's decision-makers indicate that a rate cut may be possible.

The US dollar index, which measures the exchange rate of the US dollar against a basket of currencies including the Japanese yen and the euro, fell 0.19% to 108.00; The euro rose 0.14% to $1.0422. Due to a series of executive orders issued by Trump on his first day in office without imposing tariffs, the US dollar exchange rate plummeted 1.2% on Monday, marking the largest single day drop since November 2023.

On January 13th, the US dollar briefly climbed to a two-year high of 110.17 due to the strong performance of the US economy and expectations of widespread tariffs, which could put pressure on other countries' currencies.

Thursday's data showed that the number of new unemployment claims in the United States only slightly increased last week, indicating that employment growth remained robust in January. On Monday, Trump signed a trade memorandum ordering federal agencies to review a range of trade issues before April 1, which many market participants believe will be a key date for announcing tariff plans.

The pound rose 0.31% to $1.2354. The Mexican peso rose 0.92% against the US dollar to 20.329. The Canadian dollar rose 0.16% against the US dollar to 1.435 Canadian dollars. After the inflation data released earlier this week fell below the 2% target, the Bank of Canada is expected to cut interest rates at next week's policy meeting. The Japanese yen rose 0.33% against the US dollar to 155.99 yen.

international news

Trump: If you don't produce in the United States, you have to pay huge tariffs

On the 23rd, US President Trump delivered a video speech at the World Economic Forum 2025 Annual Meeting, stating that if products are not produced in the United States, they will face tariffs of "hundreds of billions or even trillions of dollars". Trump said his message to global businesses is to 'produce products in the United States', otherwise different amounts of tariffs must be paid, which will result in hundreds of billions or even trillions of dollars entering the US treasury. He also promised to reduce the corporate tax on products produced in the United States to 15%. Trump also criticized the EU for high tariffs, strong regulatory restrictions, and a large trade deficit with the United States. He stated that measures will be taken regarding this because it is "very, very unfair to the United States". When asked if the United States would guarantee natural gas supply to Europe, Trump gave a positive answer. He stated that he will reach an energy agreement with Europe and emphasized the importance of the United States supplying liquefied natural gas to the European Union. Trump also stated plans for large-scale intervention in the world oil market and called on countries such as Saudi Arabia and the Organization of the Petroleum Exporting Countries (OPEC) to "reduce oil costs". On the Russia-Ukraine conflict, Trump said that the United States will work to ensure that the conflict is resolved peacefully.

California State Legislature approves $2.5 billion for responding to Los Angeles fire

On January 23rd local time, the California State Legislature passed a fire rescue plan worth over $2.5 billion to address recent fires in the Los Angeles area. The funds for this plan will be used for emergency evacuation, resettlement of survivors, and cleaning up hazardous waste. In addition, the state government has approved $4 million to support local governments in simplifying the housing reconstruction approval process, and $1 million to fund the reconstruction of affected schools. The plan has received support from both parties and has now been submitted to California Governor Gavin Newson for signature.

Trump: Will demand Saudi Arabia and OPEC to lower oil prices, requiring the former to invest $1 trillion in the United States

Trump announced at the World Economic Forum in Davos, Switzerland on Thursday that he will demand Saudi Arabia and the Organization of the Petroleum Exporting Countries (OPEC) to lower oil prices, and said he will ask Riyadh to increase the proposed investment package for the United States from the initial $600 billion to $1 trillion. "If the oil price drops, the Russia-Ukraine conflict will end immediately," Trump said.

Hungary will provide natural gas transit services for Slovakia

On January 23rd local time, Hungarian Foreign Minister Szijjardo stated that Hungary is ready to fully utilize its gas transmission capacity to provide natural gas transit services for Slovakia. According to Seattle, the country received 7.6 billion cubic meters of natural gas through the "Türkiye Creek" pipeline last year, so it still has about 900 million cubic meters of usable capacity, which can be used to improve Slovakia's energy demand. In addition, the Hungarian Foreign Minister emphasized at the press conference that Hungary has the right to decide its energy sources and transportation routes, and firmly opposes any country's pressure on its energy policy. He accused Ukraine of terminating the transit of Russian natural gas as "unacceptable" and threatening regional energy security. "It is unacceptable for EU candidate countries to cause trouble for energy supply to EU member states.

Insiders: EU plans to extend natural gas storage target until 2027

According to informed sources, the European Commission plans to seek an extension of the natural gas inventory target in the European region until 2027 to help alleviate ongoing supply concerns. The EU introduced natural gas storage targets during the peak of the energy crisis in 2022 to ensure sufficient supply during the coldest periods. This system will expire at the end of 2025, and the EU's administrative agencies are drafting a draft measure to extend it. This proposal will require approval from member states and the European Parliament, and the process is expected to end by the end of June.

Saudi Finance Minister: Saudi Arabia seeks to decouple economy from oil

Saudi Arabia's finance minister stated at the World Economic Forum that as part of the country's long-term economic transformation plan, Saudi Arabia's goal is to achieve economic diversification. He said, "Decoupling the Saudi economy from the oil economy is the overall concept behind Saudi Arabia's 2030 vision." Saudi Arabia's 2030 vision refers to the country's ambitious economic blueprint. The Saudi finance minister is optimistic about the new US government and emphasized Saudi Arabia's "solid fiscal buffer", which will help the country achieve its goal of investing $600 billion in the US over the next four years. Jadan added that the recovery of the US economy will benefit the overall development of the global economy.

The number of initial jobless claims in the United States has slightly increased, but the number of continuous applicants has surged to a three-year high

The number of first-time applicants for unemployment benefits in the United States has slightly increased, but the number of continuous applicants has reached a record high in over three years. As of the week ending January 18th, the number of first-time applicants for unemployment benefits increased by 6000 to 223000. The median forecast of economists in opinion polls is 220000 people. The data released by the Ministry of Labor on Thursday showed that the number of people continuously applying for unemployment benefits in the previous week jumped to 1.9 million, reaching the highest level since November 2021. This indicates that the unemployed need to spend more time to find a job. However, weekly data often fluctuates greatly, especially at this time of year.

Domestic news

National Energy Administration: Cumulative installed capacity of distributed photovoltaic power generation reaches 370 million kilowatts

The latest data shows that by the end of 2024, the cumulative installed capacity of distributed photovoltaic power generation reached 370 million kilowatts, 121 times that of the end of 2013, accounting for 42% of the total installed capacity of photovoltaic power generation. In terms of new installed capacity, the new installed capacity of distributed photovoltaic power generation in 2024 reached 120 million kilowatts, accounting for 43% of the new installed capacity of photovoltaic power generation that year. In terms of power generation, the distributed photovoltaic power generation in 2024 is 346.2 billion kilowatt hours, accounting for 41% of the photovoltaic power generation.

The Shanghai Stock Exchange will release four indices, including the quality and growth of dividends, on January 24th

The Shanghai Stock Exchange announced today that it will officially release the Shanghai Stock Exchange Dividend Quality Index, Shanghai Stock Exchange 180 Dividend Quality Index, Shanghai Stock Exchange Dividend Growth Index, and Shanghai Stock Exchange 180 Dividend Growth Index on January 24th, providing more investment targets for the market. The Shanghai Stock Exchange Dividend Quality Index series reflects the overall performance of securities of listed companies with strong dividend and profitability characteristics in the Shanghai Stock Exchange, while the Shanghai Stock Exchange Dividend Growth Index series reflects the overall performance of securities of listed companies with continuous dividend growth in the Shanghai Stock Exchange.