stock market

The main stock indexes of the US stock market rose on Tuesday, with the S&P 500 and Dow Jones Industrial Average closing at their highest levels in over a month. Investors weighed Trump's first move as the US president and were encouraged by his failure to impose comprehensive tariffs at the beginning of his second term.

Trump did not outline a specific plan for comprehensive tariffs and additional surcharges on trading partners as he had promised before, but stated that he is considering imposing tariffs on Canadian and Mexican goods as early as February 1st. Although investors remain wary of the possibility of tariffs and global trade wars driving up inflation, Goldman Sachs has lowered the probability of imposing comprehensive tariffs this year from its December forecast of around 40% to 25%.

Carol Schleif, Chief Market Strategist at BMO Private Wealth, said, "The lack of mention of tariffs in yesterday's first round of administrative action is undoubtedly a relief and somewhat surprising. The market has concluded that the government will take a more nuanced approach, which may be correct

Schleif said that investors hope the new government will use the threat of trade tariffs as a negotiation strategy and "adopt a surgical knife instead of a hammer" on tariff issues.

However, given that trade policies are not yet clear, Schleif warns that if Trump launches a probing balloon on tariffs, the market may face volatility as it has been a long time since there was a 10% correction.

As a sign of broader market strength, the Russell 2000 Index of small cap stocks, mainly in the domestic market, rose 1.85%, outperforming the index of large cap stocks.

Among the 11 major sectors of the S&P 500 index, the only one that fell was the energy sector, with a decrease of 0.64%, while six sectors rose at least 1%.

The industrial sector saw the largest increase, rising 2.03%. Driven by stocks such as 3M, 3M's fourth quarter profit performance was optimistic, and the stock price rose 4.2%.

According to the FedWatch tool of CME Group, economists predict that the Federal Reserve will keep interest rates unchanged at next week's meeting, and traders expect the first rate cut to be in June.

King City

The gold price surged to its highest level in over two months on Tuesday, supported by the weakening of the US dollar and the uncertainty of potential tariffs imposed by US President Trump, causing the market to flock to safe haven gold.

Spot gold climbed 1.3% to $2742.48 per ounce, reaching its highest level since November 6th and approaching the record high of $2790.15 set in October. US futures closed 0.4% higher, with a settlement price of $2759.20.

Daniel Ghali, a commodity strategist at TD Securities, said, "Today's trend is mainly related to the threat of a package of tariffs imposed by the United States after Trump's inauguration. Information about potential tariffs is being released bit by bit

Trump did not provide any specific details regarding the imposition of universal tariffs or additional surcharges on major trading partners, which was an important aspect of his campaign. However, he hinted that tariffs on Canadian and Mexican goods could be imposed as early as February 1st.

Peter Grant, Vice President and Senior Metals Strategist at Zaner Metals, said: "The market may still be waiting for next week's Federal Open Market Committee (FOMC) meeting and personal consumption expenditure (PCE) price index, especially inflation data. I don't think anyone would expect the Federal Reserve to take any action next week, but they will definitely closely monitor the policy statement for hints about the remaining time of the year. "

Spot silver rose 0.9% to $30.77 per ounce. Palladium rose 1.1% to $955.50; Platinum has not changed much, at $942.40.

Oil market

Oil prices fell on Tuesday after US President Trump declared a national energy emergency on his first day in office, sparking concerns in the market about increased US production. The market generally expects an oversupply this year.

Brent crude oil futures closed down 1.1%, settling at $79.29 per barrel. US crude oil futures for February delivery fell 2.6% to $75.89.

The more actively traded March US crude oil contract fell 2%, settling at $75.83 per barrel. Due to a public holiday, US crude oil was not settled on Monday.

Mizuho analyst Robert Yawger said, "Ultimately, there is no shortage of oil," pointing out that US oil production is at record levels and OPEC+is still reducing production by approximately 5.86 million barrels per day. What is lacking now is demand, "he said." If refineries don't need to produce more fuel, they won't buy crude oil

It is expected that the oil market will experience oversupply this year, as weak economic activity and energy transition efforts have severely affected the demand of the largest oil consuming countries. The US Energy Information Administration (EIA) reiterated on Tuesday its expectation for a decline in oil prices in the next two years.

Trump also stated that he is considering imposing a 25% tariff on goods imported from Canada and Mexico starting from February 1st, instead of announcing the tariff on his first day in office as previously promised. Trump stated that his government is "likely" to stop purchasing oil from Venezuela, and subsequently the decline in oil prices was limited. The United States is the second largest buyer of Venezuelan oil, and Trump has promised to replenish strategic oil inventories, but analysts question whether this will change oil demand.

currencies

The US dollar rose and fell in volatile trading on Tuesday, as the market struggled with uncertainty over any tariffs that President Trump may implement. Trump has stated that he is considering imposing tariffs of approximately 25% on goods imported from Canada and Mexico starting from February 1st. He also proposed the possibility of universal tariffs, but stated that the United States is not yet prepared.

As the US dollar attempted to rebound from Monday's sharp decline, it rose as high as 0.68% at the beginning of the session. On his first day in office, Trump did not develop a specific tariff plan, and officials stated that any new taxes would be collected in a restrained manner, which breathed a sigh of relief into trade risk currencies.

Helen Given, a foreign exchange trader at Monex USA, said that volatility is clearly showing signs of resurgence. After the relatively calm trend during Biden's tenure, any tariff comments from the Trump administration in the foreign exchange market are imminent. However, Trump's tariff proposals are still just suggestions. Traders are trying to proactively address tariff risks in Mexico and Canada, but attempting to hedge around these actions before they materialize will make the market very unstable, and we have seen this price trend today.

The US dollar index, which measures the exchange rate of the US dollar against a basket of currencies including the Japanese yen and the euro, rose 0.01% to 108.00 after falling 1.24% on Monday. After hitting a two-year high of 110.17 points last week, mainly affected by tariff expectations, the US dollar has shown signs of weakness, falling in five out of the past six trading days.

What you see here is how crowded the long positions in the US dollar are, all you need is some ambiguity about tariffs, and then you will see this trend, "said Erik Bregar, Director of Foreign Exchange and Precious Metals Risk Management at Silver Gold Bull

The euro rose 0.11% to $1.0425. The EU is also seen as a potential target of Trump's tariff policies. The pound rose 0.04% to $1.2328.

Trump said he will make up for the trade imbalance by imposing tariffs or purchasing more American oil and gas from Europe. A subsequent trade memorandum instructed various institutions to investigate and rectify the persistent trade deficit.

Analysts from Barclays Bank said that this memorandum should be seen as a "blueprint for the next expected steps on tariff issues," and April 1st, the date when institutions submit reports, will be an important day. "

The Canadian dollar fell 0.17% to 1.43 Canadian dollars against the US dollar; The Mexican peso fell 0.64% to 20.649 against the US dollar.

Economic data shows that Canada's inflation rate slowed to 1.8% in December, which may provide room for the Bank of Canada to cut interest rates again at next week's policy meeting.

The US dollar fell 0.03% to 155.54 against the Japanese yen. In the past four trading days, the Japanese yen has strengthened against the US dollar on three days due to increasing expectations that the Bank of Japan will raise interest rates on Friday.

international news

A rare strong cold front swept across the southern United States, with multiple areas issuing blizzard warnings, putting the Texas power grid once again under severe test

A highly unusual winter storm has begun to ravage the southern United States, with warnings of record snowfall issued in Houston and New Orleans, and the transmission grid in Texas will once again face severe weather conditions. The low-pressure system has shrouded vast areas from Texas to North Carolina in severe cold, causing widespread paralysis of railway and civil aviation transportation. The system will cause heavy snowfall throughout the southern Gulf of Mexico, "meteorologist Donald Jones said," followed closely by another strong cold front and even more piercing temperatures, which is highly unusual for the Gulf Coast

Russia's maritime crude oil exports have significantly decreased, and the effects of new US sanctions are becoming apparent

Preliminary signs indicate that the comprehensive sanctions imposed by the US government on Russian oil trade are taking effect, with Russia's maritime crude oil exports experiencing the largest decline since November last week. According to the compiled ship tracking data, the decline in exports has caused the four week average with low volatility to remain below 3 million barrels per day for the fourth consecutive week, approaching the lowest point in the past 16 months. According to ship tracking data and port agent reports, as of the week ending January 19th, a total of 26 oil tankers were loaded with 19.26 million barrels of Russian crude oil. This is 21.06 million barrels lower than the previous week's 27 ships. As of January 19th, the daily crude oil flow decreased by about 260000 barrels compared to the previous week, to 2.75 million barrels, a decrease of 9%.

Former Mexican trade negotiator: Trump sees tariffs as negotiation tool

Former negotiator of the United States Mexico Canada Trade Agreement (USMCA), Kenneth Smith, stated at an event held by the Mexican stock exchange Bolsa Institucional de Valores that US President Trump sees tariffs as a negotiating tool. Smith said that Trump's move to impose a 25% tariff on products from Mexico and Canada would mean the expiration of the USMCA agreement.

The US Senate Finance Committee votes to approve the nomination of Besson as Secretary of the Treasury

On January 21st local time, the US Senate Finance Committee approved the nomination of Scott Bessent as the Secretary of the Treasury for the Trump administration with a vote of 16 in favor and 11 against, and submitted the nomination to the Senate for final confirmation. If approved, Besent will become one of the important spokespersons for the new US government in economic policy, with significant influence on fiscal policy, financial regulation, international sanctions, and overseas investment.

Near East Relief Agency: Gaza reconstruction work exceeds institutional capacity

The United Nations Relief and Works Agency for Palestine Refugees in the Near East (UNHCR) stated that the reconstruction process in the Gaza Strip has exceeded its capacity due to the severe destruction of various aspects of life in the area. In a statement, the Near East Relief Agency stated that with over a thousand aid trucks entering the Gaza Strip, the agency's workload has doubled in the past two days, and thousands of staff are working tirelessly to distribute food. The organization can currently assist in restoring the infrastructure of refugee camps, allowing employees to return to work in the camps, and operating the wells in the camps. But the basic service infrastructure of the entire Gaza Strip still needs to be given special attention.

Greenland Prime Minister seeks direct dialogue with Trump, emphasizes once again that the island will not be sold

The Greenland Prime Minister expressed a desire to communicate directly with the Trump administration, as the current US president is increasing pressure on Denmark to relinquish control of the Arctic island. Greenland Prime Minister Mute B. Egede said at a press conference on Tuesday that Greenlanders do not want to become Americans or Danes. Since Trump expressed interest in Greenland last month, he has made this statement multiple times.

Scholz urges EU to sign more free trade agreements

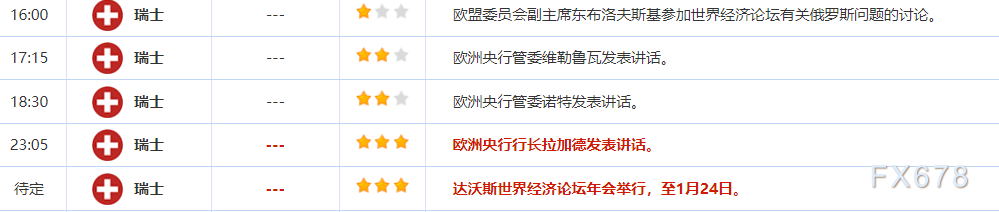

German Chancellor Scholz stated at the World Economic Forum in Davos, Switzerland that the European Commission should reach free trade agreements with countries such as India, Indonesia, and Malaysia. Scholz said that the trade agreements recently signed by the European Commission with Mexico and the Southern Common Market (Argentina, Bolivia, Brazil, Paraguay, and Uruguay) should not be final. He said, "If the EU reaches more free trade agreements with other countries and regions, it will create wealth

At least two new wildfires have occurred in Southern California due to increased wind power

On January 21st local time, the wind in Southern California, USA strengthened, and at least two new wildfires occurred. Due to low humidity and destructive 'Santa Ana winds', the National Weather Service has issued a warning stating that parts of Los Angeles, Ventura, and San Diego counties in California will face' particularly dangerous conditions' from the afternoon of the 20th to the morning of the 21st. It is reported that there have been at least two minor fires in San Diego County. At present, evacuation orders have been issued. The California Forestry and Fire Department announced that the fire is spreading at a moderate rate and buildings are under threat

Domestic news

More than 570 industrial enterprises in China have been shortlisted for the top 2500 global R&D investment

Zhang Yunming, Deputy Minister of Industry and Information Technology, stated at the "China's High Quality Economic Development Achievements" series of press conferences held by the State Council Information Office on the 21st that more than 570 industrial enterprises in China have been shortlisted for the top 2500 global R&D investment, accounting for nearly 1/4. At present, the total number of high-tech enterprises within the validity period has reached 463000, and the number of industrial high-tech enterprises above designated size has reached 169000.

The Ministry of Commerce holds a European Enterprise Roundtable

Ling Ji, Deputy Minister of Commerce and Deputy Representative for International Trade Negotiations, presided over the European Enterprise Roundtable to listen to suggestions on issues related to European enterprises in China. Representatives from the Ministry of Finance, the National Medical Products Administration, and other departments attended the meeting. Ling Ji stated that the foundation of China EU economic and trade cooperation is solid, with deep integration of the production supply chain and value chain, sufficient cooperation momentum, and great potential. China not only has a vibrant and large-scale market, but also has a complete industrial and supply chain, concentrated innovation resources, and rich application scenarios. It is an important part of the global market, which is conducive to long-term investment by European enterprises. Welcome European companies to leverage their own advantages and enhance their competitiveness by investing in and deeply cultivating China. The Ministry of Commerce will continue to provide excellent service guarantees for foreign-funded enterprises, including European enterprises, to invest and operate in China. Representatives from over 70 foreign-funded enterprises, including BNP Paribas, Eni, Roche Diagnostics, Novartis, IKEA, SAP, Transsion, Nokia, as well as representatives from the European Union Chamber of Commerce in China, the German Chamber of Commerce in China, and other business associations, attended the conference. The attending representatives expressed their willingness to contribute to further deepening China EU economic and trade cooperation, oppose decoupling and disconnection from China, and are willing to cultivate the Chinese market for a long time and share development opportunities. (Ministry of Commerce)