**********Last Friday (January 17), gold prices were suppressed by the rise of the US dollar. US housing and industrial output data were stronger than market expectations, helping US bond yields rebound after hitting a nearly two-week low. The US dollar index also stabilized and rebounded, and gold prices moved away from hitting a more than one month high last Thursday. However, the weekly gold price still rose 0.5%, closing at $2702.35 per ounce. The uncertainty of US President Trump's policies and bets on further interest rate cuts reignited, helping gold prices to rise for three consecutive weeks. On Monday, Trump's inauguration ceremony will be held, and he may announce a series of new policies that investors need to pay close attention to.

David Meger, head of metal trading at High Ridge Futures, said, "The pullback on November 17th was not significant, but more of a profit taking trend, perhaps aided by a slight increase in the US dollar during the day, adding some slight pressure

Gold hit a new high in over a month last Thursday, $65.6 short of the historic high of $2790.15 set in October. Last week, gold prices rose by 0.5%, marking the third consecutive week of increase. On Wednesday, the lower than expected core inflation data in the United States intensified market speculation that the Federal Reserve had cut interest rates more than once.

However, the US economic data released last Friday (November 18th) showed strong performance, with the US dollar and US Treasury yields stabilizing and rebounding, exerting pressure on gold prices.

The number of single family residential buildings in the United States reached a 10 month high in December, indicating an improvement in housing activity at the end of the year. However, rising mortgage rates and an oversupply of new homes in the market may constrain the recovery of the real estate market.

The report released by the US Department of Commerce last Friday also showed that single family residential building permits rose to the highest level since February last year in December. Economists said that the data was likely affected by a looser seasonal adjustment factor, and the government used this model to eliminate seasonal fluctuations in the data.

However, this report and the data released last Friday reflecting the surge in manufacturing output, combined with steady growth in retail sales, indicate that the economy maintained most of its strong growth momentum in the fourth quarter.

President elect Trump has promised to impose widespread tariffs and deport illegal immigrants on a large scale. Economists warn that these policies will push up material prices and lead to worker shortages, making it difficult to sustain growth in housing construction and factory output. Trump will be sworn in on Monday.

Thomas Ryan, a North American economist at Capital Economics, said, "We expect that under the leadership of the new Trump administration, a series of factors affecting the labor force in the construction industry, such as building material tariffs and stricter immigration regulations, as well as an oversupply of new homes for sale in some regions, will hinder builders from launching new projects in the second half of this year and even in 2026, leading to a decline in housing construction rates.

According to the Bureau of Statistics of the US Department of Commerce, the construction of single family homes, which accounted for the majority of residential construction in December, increased by 3.3% month on month, with a seasonally adjusted annual rate of 1.05 million units, the highest level since February 2024. The construction of single family homes decreased by 2.6% year-on-year.

The construction of multi household residential properties with significant fluctuations surged by 58.9% month on month, with an annual rate of 418000 units. The overall housing construction increased by 15.8% month on month, with an annual rate of 1.499 million units, the highest level since February last year. Economists surveyed by Reuters previously predicted that the annual rate of housing starts would rise to 1.32 million units.

The construction of multi household residential buildings decreased by 4.4% year-on-year. The estimated housing construction in 2024 is 1.364 million units, a decrease of 3.9% from 2023.

The construction permits for single family residential properties increased by 1.6% month on month in December, with an annual rate of 992000 units.

Samuel Tombs, Chief US Economist at Pantheon Macroeconomics, stated that "the high level of unsold inventory of new homes on builders' books indicates that any eventual rebound in demand will only have a weak impact on construction activity when mortgage rates ultimately decline.

The number of multi household residential building permits decreased by 5.8% month on month, with an annual rate of 437000 units. The overall building permit decreased by 0.7% month on month, with an annual rate of 1.483 million units. Compared to the same period last year, it has decreased by 3.1%. It is estimated that a total of 1.471 million building permits were issued in 2024, a decrease of 2.6% compared to 2023.

The number of single family homes approved for construction but not yet started decreased by 2.1% to 141000 units. The completion rate of single family homes decreased by 7.4% to 948000 units, the lowest level since March. The stock of single family residential properties under construction increased by 0.8% to 641000 units.

Residential investment has dragged down the US Gross Domestic Product (GDP) for two consecutive quarters. The Atlanta Federal Reserve predicts a quarter on quarter GDP growth rate of 3.0%. The year-on-year economic growth rate in the third quarter was 3.1%.

Another report from the Federal Reserve showed that industrial production in December increased by 0.6% month on month, with production of aerospace and miscellaneous transportation equipment growing by 6.3%, which also boosted economic growth in the previous quarter.

Industrial production rebounded by 0.4% in November. The manufacturing industry accounts for 10.3% of the total economy and has stabilized in recent months after the Federal Reserve began cutting interest rates. However, Trump's proposed trade and immigration policies pose a downside risk.

The interest rate cut will support the purchase of goods such as cars and heavy machinery, "said Gus Faucher, Chief Economist of PNC Financial. But the price increase caused by tariffs may suppress demand. Many American producers use foreign inputs in their manufacturing processes

Traders expect two interest rate cuts before the end of the year, and Federal Reserve Governor Waller hinted that if economic data further weakens, there may be more interest rate cuts.

The yield of US treasury bond bonds rose slightly last Friday, and the intraday trading was choppy. A series of data on housing and industrial production had improved again, supporting the expectation that the Federal Reserve would slow down the pace of interest rate cuts and that interest rates might be cut only once in 2025.

Prior to the inauguration of US President elect Trump on Monday, investors were generally hesitant to make significant bets due to uncertainty surrounding tariffs, tax cuts, and immigration policies. Monday is Martin Luther King Jr. Day, and the bond market is closed.

The US two-year treasury bond bond yield, which tracks the Fed's interest rate expectations, rose 3.4 basis points to 4.272% on Friday, after hitting a two-week low of 4.221%.

However, the yield of two-year treasury bond fell 12.4 basis points last week, the biggest weekly decline since the end of November.

The yield of 10-year treasury bond rose 0.1 basis points to 4.613% on Friday, after falling to the lowest level in two weeks. Last week, the yield fell by 16.1 basis points, marking the largest weekly decline in seven weeks.

FHN Financial macro strategist Will Compernolle said, "Many sell offs are actually just recalibrations of the past few days. The Consumer Price Index (CPI) has clearly changed the notion that inflation is hopeless

Last Wednesday's data showed that after excluding the volatile food and energy sectors, the core CPI growth slowed down in December, only increasing by 0.2% after a 0.3% increase in November. Previously, the core CPI had risen by 0.3% for four consecutive months.

Compernolle said, "The rise in yields on January 17th was not so remarkable. People are just waiting for all the administrative actions next week

According to data from the London Stock Exchange Group (LSEG), after the release of economic data, the expected rate cut for 2025 in the US interest rate futures market has increased from about 43 basis points late Thursday to 39 basis points. The market also believes that the probability of the next interest rate cut occurring at the Federal Reserve's June meeting is 66%.

We believe that over time, the yield should decrease, "said Bill Merz, head of capital market research at U.S. Bank Asset Management. Our inflation data has shown a significant seasonal adjustment, which is also one of the reasons why people are concerned about what actions the Federal Reserve will take and how much they will cut interest rates this year

However, Merz stated that there is downward pressure on inflation, which should manifest in some form in the coming quarters. He cited examples such as the slowdown in US housing inflation, which accounts for half of consumer prices, and the impact of China's inflation slowdown on exports to the US, which has been a sustained trend over the past two years.

Merz stated that U.S. Bank Asset Management expects the Federal Reserve to cut interest rates twice in 2025, which is consistent with the Fed's own forecast in December.

The market is currently eagerly anticipating Trump's inauguration ceremony on January 20th, and his extensive trade tariffs are expected to further ignite inflation and trigger a trade war, potentially increasing the safe haven appeal of gold.

In the past few weeks, the US dollar has jumped because of the rise in the yield of US treasury bond bonds, reflecting the expectation that Trump's policies may stimulate inflation when the US economy is already strong. But last Wednesday, the United States released softer core inflation data, coupled with Federal Reserve Governor Waller's statement on Thursday that if the data supports, it is still possible to cut interest rates three to four times in 2025, giving the bond market a breathing space from the ruthless sell-off.

This has led to increased market bets on a Fed rate cut in 2025, putting some pressure on the US dollar before Trump returns to the White House this week.

The US dollar index rose 0.34% last Friday to 109.33, far from the over two-year high hit earlier last week. The US dollar index fell by about 0.22% last week, breaking six consecutive weeks of gains.

In response to the lower than expected inflation data over the past week, market participants have adjusted their expectations for interest rate cuts from 25 basis points to 40 basis points, "said Uto Shinohara, senior investment strategist at Mesirow Currency Management." It is worth noting that these market expectations have returned to the levels before last Friday's strong employment report, indicating that the impact of these two economic data is actually offsetting each other

He added that this model highlights the sustained sensitivity of the market to inflation and labor market data.

As Federal Reserve officials enter a period of silence and there are hardly any important US economic data releases this week, Shinohara said, "The market will focus on the beginning of President Trump's term and its potential impact on the market

Investors are now waiting for Trump's inauguration speech on Monday to better understand his policy actions and anticipate volatility.

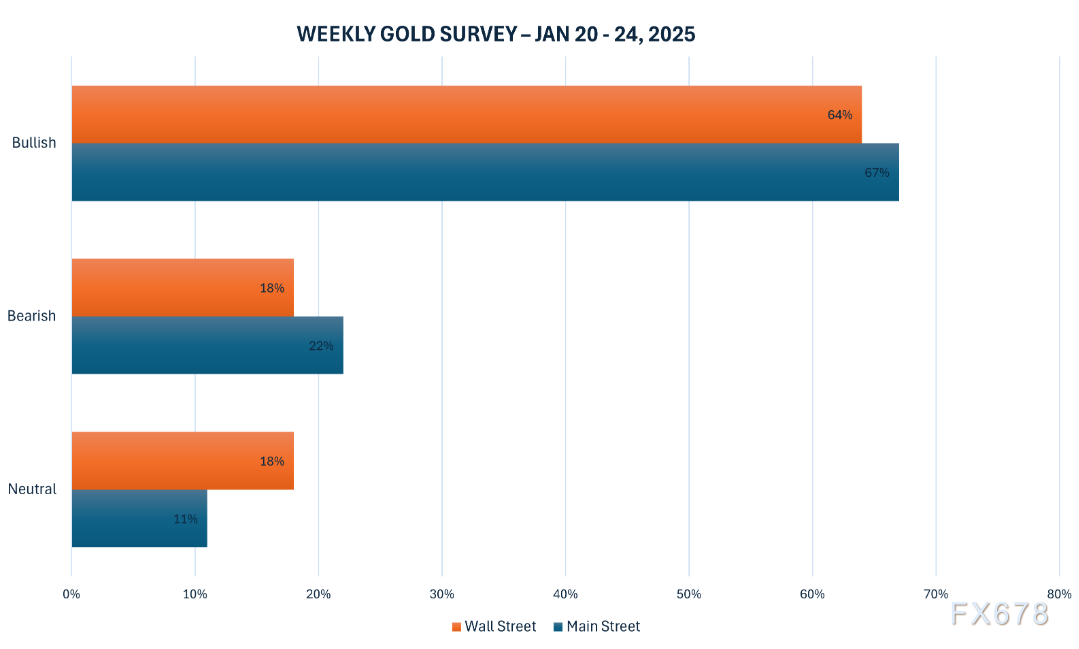

The latest Kitco News weekly gold survey shows strong bullish sentiment among industry experts and retail traders before Donald Trump's second inauguration.

Last week, 11 analysts participated in the Kitco News gold survey, and nearly two-thirds of the respondents expected gold prices to rise in the coming days. Seven experts (64%) predict that gold prices will rise in the coming week, while two analysts (18%) predict a decline in precious metal prices. The other two analysts choose to wait and see until the situation becomes clearer.

Meanwhile, Kitco's online poll conducted a total of 156 votes, with retail investors only slightly more optimistic than experts. 105 retail traders (64%) expect gold prices to rise in the coming week, while another 34 retail traders (22%) expect gold prices to fall. The remaining 17 investors (11% of the total) expect gold prices to consolidate sideways in the near future.