stock market

The US stock market closed higher on Tuesday, with Nvidia and other AI related tech stocks rebounding from Monday's sharp decline as investors bought on dips.

The Nasdaq index rose 2%, and the leading stock price of artificial intelligence chips surged 8.9%. The previous day, its stock price plummeted 17%, and its market value evaporated by about $593 billion, setting a record for the largest daily market value loss of any company.

The S&P 500 technology sector surged 3.6%, marking its largest single day percentage increase since July 31, while the semiconductor index rose 1.1%. Apple's stock price rose by 3.7%. Investors are eagerly awaiting the quarterly financial reports to be released by companies such as Apple and Microsoft later this week.

Rick Meckler, a partner at Cherry Lane Investments, said, "We have seen a typical rebound market, which usually occurs when you encounter less specific and more potential future changes in news. Some of the technology stocks in the market, especially those around artificial intelligence, are ready to sell, and this news provides an excuse for them. Today, you see bargain hunters re entering the market, and some people are reserved about deep search news because we don't know much about it." Nvidia's forward P/E ratio has fallen to its lowest level since December 2023.

The optimism towards artificial intelligence has driven strong gains in Nvidia and the stock market for most of the past two years. US President Trump announced on Monday evening that he plans to impose tariffs on imported computer chips, drugs, and steel. On Wednesday, the market generally expected the Federal Reserve to keep interest rates unchanged in its first interest rate decision of the year.

King City

Gold prices rebounded on Tuesday as investors remained interested in this safe haven asset amid increasing uncertainty over US President Trump's proposed tariffs. The gold price fell on the previous trading day due to the overall sell-off of technology stocks leading the market.

Spot gold rose 0.8% to $2762.02 per ounce. Stimulated by DeepSeek's low-cost, low-power artificial intelligence model, gold fell more than 1% in the previous trading day, marking its largest decline since December 18th. US futures closed up 1.1% at $2767.50.

Daniel Pavilonis, Senior Market Strategist at RJO Futures, said, "I think the biggest factors were Trump's comments about tariffs yesterday... and now, what's related to gold is a basket of geopolitical situations and inflation expectations." Trump said on Monday that he plans to impose tariffs on imported computer chips, drugs, and steel to encourage producers to produce these products in the United States. Trump's policies are not only believed to trigger inflation, but may also lead to trade tensions, thereby increasing safe haven demand for gold.

Investors are now focusing on the Federal Reserve's first policy meeting of the year, scheduled to begin later. It is expected that decision-makers will maintain the interest rate unchanged at the end of the two-day meeting.

A Reuters survey shows that due to increased economic uncertainty and inflation concerns, gold prices are expected to reach a historic high this year. However, due to the difficulty in significantly improving demand, analysts have lowered their forecasts for platinum and palladium prices in 2025.

Spot silver rose 0.8% to $30.43 per ounce; Palladium fell 0.8% to $952.84; Platinum also fell 0.7% to $940.77.

Oil market

Oil prices rose on Tuesday, rebounding from weeks low. The White House stated that US President Trump still plans to impose tariffs on imported goods from Canada and Mexico this week. Concerns about weakened demand due to rising temperatures in other regions have suppressed the increase.

Brent crude oil futures closed up 0.53%, settling at $77.49 per barrel. US crude oil futures rose 0.82% to $73.77.

The White House stated that Trump still plans to impose a 25% tariff on Canada and Mexico on Saturday. Phil Flynn, an analyst at Price Futures Group, said, "Trump's remarks about tariffs have put the market on edge." The tariffs could disrupt the flow of energy products between the United States and Canada and Mexico.

Local protesters in Libya blocked crude oil loading at Es Sider and Ras Lanuf ports on Tuesday, putting at risk approximately 450000 barrels per day of crude oil exports. However, after meeting with protesters, the Libyan National Oil Company stated that export activities are operating normally and concerns about supply disruptions have eased.

The weather forecast shows that the temperature in the United States will be higher than normal this week, which will also put pressure on the demand for heating fuels. The extreme cold weather in the past few trading days has driven up natural gas and diesel prices.

currencies

The US dollar rose against the Japanese yen on Tuesday as the Trump administration issued new tariff threats, easing concerns about China's low-cost artificial intelligence (AI) model. President Trump announced on Monday that he plans to impose tariffs on imported computer chips, drugs, and steel to persuade manufacturers to produce these products in the United States.

According to the Financial Times, Treasury Secretary Bessent, who was confirmed by the US Senate on Monday, has also been pushing for a new universal tariff on imported products, with a starting rate of 2.5% and gradually increasing by the same amount every month.

The US dollar rose 0.6% against the Japanese yen to 155.52 yen, ending three consecutive days of decline. The US dollar rose 0.21% against the Swiss franc to 0.904 Swiss francs, and is expected to end its two-day decline. Steve Englander, Head of G10 Forex Research at Standard Chartered Bank, said: 'I think there are two themes happening simultaneously here, and the impact of one of them is fading. The problem in the AI field was initially viewed from the perspective of the stock market as a safe haven.'. This led to the rise of the US dollar against almost all high beta currencies, while the Japanese yen and Swiss franc performed well in this situation as they are safe haven currencies. Then, Trump mentioned tariffs, which have different impacts on different currencies. "

The day before Trump issued his latest tariff threat, the United States and Colombia stepped back from the brink of trade tensions, with the White House stating that Colombia had agreed to accept military planes transporting deported immigrants. Trump also stated that he may impose a 25% tariff on goods imported from Canada and Mexico on February 1st, and threatened to impose tariffs on the European Union as well.

The euro fell 0.55% to $1.0433. The pound fell 0.45% to $1.244; The Canadian dollar fell 0.2% against the US dollar to 1.44 Canadian dollars. The Mexican peso rose 0.76% against the US dollar to 20.505 pesos, marking its largest daily decline since June of last year.

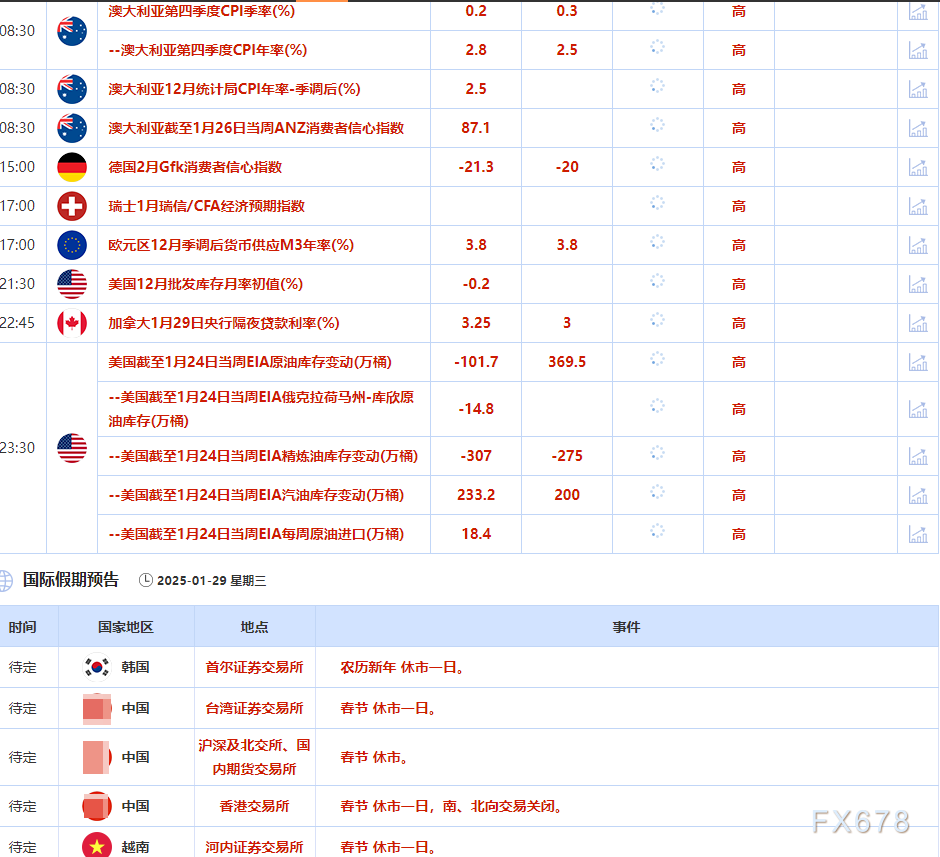

The two-day meeting of the Federal Reserve will end on Wednesday and is expected to maintain interest rate stability. The European Central Bank will also hold a meeting this week and is expected to cut interest rates. People generally expect that the Bank of Canada is likely to lower its key indicator interest rate by 25 basis points on Wednesday.

Former Bank of Japan reviewer Makoto Sakurai stated that the Bank of Japan may raise interest rates again around June or July and seek to double the policy rate to at least 1.5% in the next two years. The Bank of Japan raised its short-term interest rate from 0.25% to 0.5% last week.

Amarjit Sahota, Executive Director of Klarity FX, said, "Now, for tomorrow's Federal Reserve, I think their only thought is: how can we steer steadily? Because since inauguration day, we still don't have a clear understanding of tariffs or trade. We know the government also wants to reduce spending. I don't think this has much impact on the Fed's interest rate expectations. We still reluctantly believe that the Fed will cut interest rates once in the summer

international news

US media: White House proposes' buyout 'for federal employees unwilling to return to office

According to Axios website, a White House official stated that the White House will issue a memorandum on Tuesday afternoon proposing that federal workers who do not wish to return to the office will be paid their salaries until September 30th if they resign before February 6th. A senior government official told Axios: "The email sent today is to ensure that all federal staff comply with the plan of the new government, let federal employees work in the office and comply with higher standards. Five years after the COVID-19 epidemic, only 6% of federal employees work full-time in the office. This is unacceptable."

First briefing after taking office, the newly appointed White House Press Secretary explains multiple Trump policies

On January 28th local time, Caroline Leavitt, the newly appointed White House Press Secretary, gave her first briefing. Levitt stated that since his inauguration, US President Trump has taken over 300 administrative measures. Levitt said that Trump believed that the AI model released by Chinese AI start-ups DeepSeek was an alarm to the US AI industry. Trump signed an executive order revoking some cumbersome regulations on the artificial intelligence industry. Levitt stated that Trump's freeze on federal government spending is only temporary, not a ban, aimed at ensuring that all funds align with Trump's agenda and that the distribution of food stamps and welfare benefits will not be affected. Levitt also stated that the date for the United States to impose tariffs on imported goods from Canada and Mexico is still set for February 1st. (CCTV)

Federal Reserve Messenger: Tariffs become a key factor in whether and when the Fed will resume interest rate cuts

Nick Timiraos, the spokesperson for the Federal Reserve, wrote that as Trump considers using tariffs more boldly, a key question looms over the Fed: to what extent will any price increase stimulate public expectations of higher inflation rates? When or whether the Federal Reserve resumes interest rate cuts largely depends on the inflation outlook, and this year's inflation outlook may depend on whether Trump fulfills his threat to raise tariffs. During Trump's first presidency, trade tensions escalated and the Federal Reserve lowered interest rates in 2019. The Federal Reserve is concerned that the impact of trade tensions on business sentiment and investment may outweigh the potential impact of price increases caused by tariffs. At that time, tariffs did not cause inflation in terms of their impact on economic activity because it was not an inflationary period, "said Steven Cumming, who was then the head of the Federal Reserve's international finance department and now works at the American Enterprise Institute. The Federal Reserve may react differently this time after the tariff hike takes effect, as the United States has just experienced a period of high inflation. He expects that the Federal Reserve will indeed be more inclined to oppose the imposition of tariffs in this round than in the previous round, and if the policy of imposing tariffs is implemented, the Federal Reserve will maintain interest rates at a higher level than before.

The Bank of England launched a repo tool to curb the risk of British treasury bond crisis

The Bank of England launched a new repo tool to provide emergency cash for financial companies outside the banking industry to avoid repeating the collapse of the British bond market in 2022. The Bank of England began accepting applications for the "Agent NBFI Repo Facility" on Tuesday, which will directly provide loans to insurance companies, pension funds, and so-called debt driven investment strategies. According to the statement, these institutions will provide British treasury bond bonds as loan collateral, and their total holdings must be worth 2 billion pounds (2.5 billion dollars) or more to qualify.

US Consumer Confidence Index Falls to Four Month Low Affected by Employment Market

Due to weakened optimism about the labor market and overall economic outlook, the US consumer confidence index unexpectedly fell to a four month low in January. The data released on Tuesday showed that the World Federation of Large Enterprises Consumer Confidence Index fell 5.4 to 104.1 in January. The median estimate of surveyed economists is 105.7. The current indicators have decreased by nearly 10 points, and the expected indicators for measuring the outlook for the next 6 months have relatively small declines. Inflation is slowly cooling down, and although the labor market looks good on the surface, job seekers are saying that they are spending more and more time looking for jobs. As consumers evaluate how Trump's policies will affect the economy, confidence indices have been fluctuating.

EU foreign ministers say Ukraine's accession process should be accelerated

On January 28th local time, EU High Representative for Foreign Affairs and Security Policy, Karas, stated that Ukraine is a priority for the EU, and the EU must not only support Ukraine in the short term, but also focus on the future. Karas believes that accelerating the initiation of Ukraine's accession process is extremely important. Polish Prime Minister Tusk recently stated that Poland will strive to break the deadlock on Ukraine's accession to the European Union during its presidency. (CCTV)

Domestic news

Future gas stations will undergo comprehensive changes

The consumption pattern of petroleum in China is undergoing tremendous changes, and the demand for refined oil products has reached a turning point and entered a downward channel. According to a report released by the China Petroleum Economic and Technological Research Institute, based on the current rate of decline in refined oil consumption, it is estimated that by 2030, the number of gas stations in China will decrease from about 110000 to 90000, and 20000 will be eliminated, making industry competition increasingly fierce. In 2024, the apparent consumption of petroleum in China remained basically the same as the previous year, but the consumption of refined oil decreased by 2.4% year-on-year. The main reason behind this is that the number of new energy vehicles has exceeded 30 million, and the mileage of LNG heavy-duty trucks has increased significantly, replacing approximately 53 million tons of gasoline and diesel. It is expected that the demand for refined oil will decrease by 1.9% in 2025. At the same time, the business model of gas stations is also changing, transitioning from simple refueling to comprehensive services that integrate multiple energy businesses. Cross border competition has become a new trend, and gas stations will usher in comprehensive changes in the future.

Over 20 cruise ships and nearly 70000 tourists will enter and exit Shanghai Cruise Port during the Spring Festival holiday

The Chinese New Year of the Snake has arrived. On the 28th, nearly 10000 passengers boarded the "Aida Magic City" and "Ocean Spectrum" cruise ships to embark on the "Maritime New Year" tour. According to statistics from the Shanghai border inspection department, nearly 70000 inbound and outbound travelers will choose to "celebrate the Chinese New Year by sea" during this year's Spring Festival holiday (January 28th to February 7th), an increase of 337.5% compared to the same period in 2024.