**********On Thursday (January 30th) morning trading in the Asian market, spot gold fluctuated narrowly and is currently trading around $2760 per ounce. The gold price fluctuated on Wednesday,Federal ReserveAfter the announcement of the interest rate decision, gold prices fell to around $2744.65 per ounce. After the press conference by Federal Reserve Chairman Powell, gold prices recovered most of their losses and closed at $2759.73 per ounce, a decrease of only 0.13%. Previously, the Federal Reserve maintained interest rate stability as widely expected by the market, but did not provide any clear information on the timing of future interest rate cuts.

Federal Reserve officials have unanimously decided to maintain the overnight interest rate in the current range of 4.25% -4.50%. The Fed is in a wait-and-see state, waiting for further inflation and employment data, as well as clarity on the impact of President Trump's policies. The Federal Reserve removed language acknowledging a slowdown in inflation in its latest policy meeting statement.

Mark Luschini, Chief Investment Strategist at Janney Montgomery Scott, stated that this change "acknowledges that inflation remains above the Fed's target and may stabilize above the target rate.

After the Federal Reserve cut interest rates three times in the second half of last year, inflation has been developing horizontally in recent months. In its latest policy statement, the Fed removed the phrase "progress" in bringing inflation back towards its 2% target, only pointing out that the rate of price increases is "still very fast".

Recent data shows that key inflation indicators are still about half a percentage point or more above the Federal Reserve's target.

Federal Reserve officials have stated that they generally believe there will be renewed progress in reducing inflation this year, but are currently suspending interest rate hikes and waiting for data to confirm this.

The Federal Open Market Committee (FOMC) stated in its latest policy statement that "economic activity continues to expand at a steady pace. The unemployment rate has remained stable at a low level in recent months, and labor market conditions remain stable“

The statement said, "When considering the magnitude and timing of further adjustments to the target range of the federal funds rate, the committee will carefully evaluate future data, changing prospects, and risk balance

Juan Perez, the head of trading at Monex USA in Washington, said, "They seem very confident that there may not be a need for any rate cuts, which is understandable

After the interest rate resolution, the US dollar index once rose 0.3%, and the yield of US treasury bond bonds once rose 1.24% to 4.588% 10 years ago. However, Powell's press conference reversed the trend. The US dollar index closed at 107.95 on Wednesday, nearly flat; The yield of US 10-year treasury bond bonds closed at 4.530% on Wednesday, also close to flat. Federal Reserve Chairman Powell said he expects to see further progress in inflation.

At a press conference, Federal Reserve Chairman Powell stated that it is too early to assess the impact of Trump's policies and emphasized that the Fed's 2% inflation target will remain unchanged.

Powell stated at a press conference that "we don't need to rush to adjust our policy stance" and that monetary policy is already "in a good position" to address the challenges at hand. He pointed out that cutting interest rates too aggressively carries risks, saying, "We know that reducing policy restrictions too quickly or too much may hinder progress in inflation

Overall, the Federal Reserve has maintained interest rate stability and has not provided any clues on when it may further reduce borrowing costs in an economic environment where inflation remains above target, the economy continues to grow, and unemployment rates are low. This means that the Federal Reserve is in a wait-and-see state, and decision-makers are waiting for further inflation and employment data, as well as clarification of the impact of Trump's policies.

After the first policy meeting of President Trump's second term, Federal Reserve Chairman Powell stated that policymakers are "waiting and watching to see what policies will be introduced" before assessing their impact on inflation, employment, and overall economic activity, and they are not in a hurry to further adjust interest rates.

Trump began his second term last week, promising to increase tariffs, crack down on immigration, reduce taxes, and relax regulations. He also stated that he will demand a rate cut and believes that the Federal Reserve will listen to him. Powell refused to respond to Trump's remarks at a press conference after the Fed's recent two-day policy meeting.

After the Federal Reserve announced its interest rate decision, Trump posted on Truth Social stating that the Fed had "failed to address the issues they have caused by inflation" and had done a "terrible job" in banking regulation.

Given President Trump's request to lower interest rates, the Federal Reserve may to some extent insist on independence, "said Peter Grant, Vice President and Senior Metals Strategist at Zaner Metals." But I believe that the policy path will largely remain unchanged. Therefore, in this sense, it may wait until mid year to cut rates

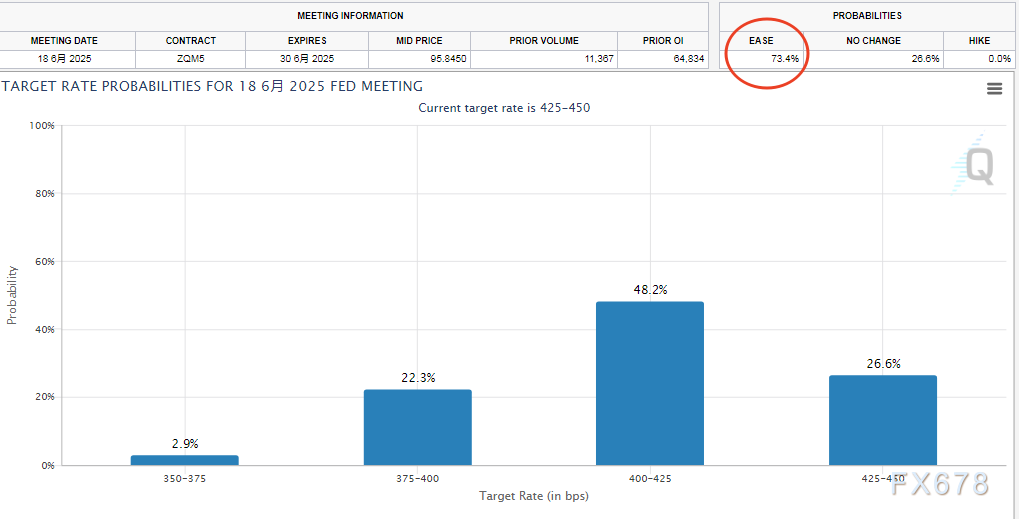

After the statement was released, investors in the short-term interest rate futures market expect the Federal Reserve to postpone further interest rate cuts before June. Traders expect a possibility of a rate cut before June to be around 40%, while previous predictions were close to 50%. The trend of interest rate futures contracts still reflects traders' belief that June is the most likely month to resume interest rate cuts. Currently, the probability of a rate cut in June is about 73.4%, and the possibility of a second 25 basis point rate cut before the end of the year is greater than the possibility of no rate cut.

The Federal Reserve seems to believe that the economy is in a state of low unemployment and high inflation, "said Brian Jacobsen, Chief Economist at Annex Wealth Management. This statement can be interpreted as slightly hawkish, implying that even a slight change in interest rates may cause the economy to deviate from this balance

This trading day will release quarterly GDP data and changes in initial jobless claims in the United States.

Wednesday's data showed that the US goods trade deficit widened significantly in December due to companies importing ahead of schedule in anticipation of the Trump administration imposing widespread tariffs.

Thomas Simons, Chief US Economist at Furui, said that this raises speculation that the US government's last quarter gross domestic product (GDP) forecast released on Thursday may be weaker than previously expected. Many people are lowering their expectations

However, Simons pointed out that strong imports will also increase inventory, which may have a offsetting impact on GDP data.

The Atlanta Fed has lowered the annualized GDP growth rate for the fourth quarter from the previous 3.2% to 2.3%. The economic growth rate for the third quarter was 3.1%.

Oliver Allen, senior US economist at Pantheon Macroeconomics, said, "We seem to have reason to believe that a large part of the reason is the effort to import raw materials before prices may jump after the implementation of new tariffs. These early purchases may continue until January. Similar waves of early purchases are likely to bring upward pressure to potential imports

According to specific data from the US Bureau of Statistics, the goods trade deficit increased by 18.0% last month, reaching $122.1 billion, the highest value since the government began tracking this series of data in 1992. The import value of goods was 289.6 billion US dollars, an increase of 10.8 billion US dollars, with a growth rate of 3.9%. Exports decreased by $7.8 billion, or 4.5%, to $167.5 billion.

If the US GDP performs poorly in the fourth quarter, it may provide upward momentum for gold prices.

It is worth mentioning that the position of the world's largest gold ETF-SPDR has increased in the past two trading days after falling to a near six-month low for five consecutive trading days. On Wednesday, it increased by 4.02 tons to 865.34 tons.