The results of the US election have been announced. In January 2025, Donald Trump will be sworn in as the 47th President of the United States. Given the significant differences between Trump's policies and 'Biden economics', it is reasonable to assume that the financial markets will experience a turbulence. But for traders, what does this mean?

Most experienced traders pay attention to three types of assets. Everyone has started to pay attention to gold, and due to Exness' goldSpread reduced by 20%At present, it is the best time to trade gold on Exness. In addition, adding indices such as the S&P 500 and crude oil to your watchlist is also a wise move. The reasons are as follows:

In his second term, Trump's economic agenda mainly revolved around active tax cuts, deregulation, and vigorously promoting energy independence.

It is important to understand the economic policies advocated by Donald Trump and their impact when evaluating the potential impact of his presidency on the economy, particularly on USOIL, SPX, and XAUUSD.

Trump issued the slogan of "drill, baby, drill" and promised to increase oil mining output, which may put pressure on oil prices.

Policy: The Trump administration's priority may be to increase domestic oil production, including measures such as deregulation, opening up federal land for drilling, and providing tax incentives for energy companies. Revoking environmental regulations may reduce the operating costs of oil companies and encourage more exploration and production activities. This approach is in line with Trump's "America First" energy policy, aimed at reducing dependence on foreign oil and lowering oil prices.

Impact: Trump's emphasis on energy independence and deregulation may lead to a significant increase in domestic oil production. Opening up federal land and accelerating drilling permits may increase supply, putting downward pressure on oil prices.

In addition, Trump's trade policies and proposals to impose tariffs on China may exacerbate geopolitical tensions, which has historically been one of the reasons for fluctuations in the oil market. Due to the fact that US crude oil exports to China account for over 10% of total exports, retaliatory tariffs may have a negative impact on these exports as Chinese importers seek alternative sources.

The tax cuts proposed by Trump may boost consumer spending and corporate profits, but inflation and economic growth risks may suppress the upward momentum of the SPX index.

Policy: In addition to extending the current tax cuts, Trump also proposed providing more tax breaks for small businesses and lifting the $10000 cap on state and local tax breaks.

Other measures include lowering the corporate tax rate from 21% to 15%, removing taxes on certain capital gains and small business income, all aimed at stimulating investment and driving economic growth.

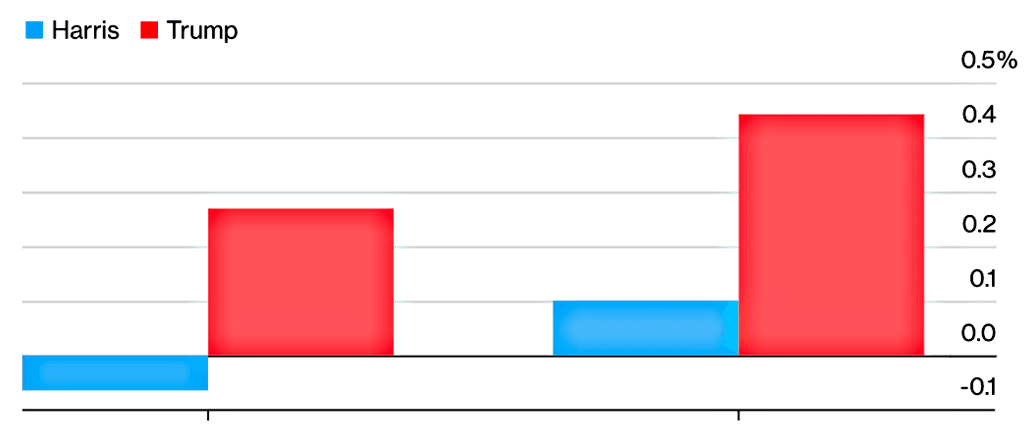

Impact: Lowering corporate taxes and relaxing regulations may lead to profit growth, thereby driving up stock prices. By 2028, Trump's tax cut plan may lead to a 0.3% increase in GDP growth rate relative to the pre election baseline (Figure 1). Supported by favorable tax policies and reduced regulatory burdens, sectors such as finance, energy, and manufacturing may perform well.

However, a major risk facing this view is that Trump's plan includes imposing aggressive tariffs of up to 60% on imported products from China, aimed at protecting American jobs. The possibility of increasing tariffs will create market uncertainty and drive inflation as imported goods become increasingly expensive. Bloomberg Economics predicts that by 2028, the inflation rate will increase by 0.4% compared to the baseline before the election (Figure 1). The rebound in inflation may prompt the Federal Reserve to pause its easing cycle and curb the upward trend of the SPX index.

How Trump and Harris' Tax Plans Will Affect Economic Growth and Price Growth

Expected impact by 2028 (relative to baseline)

Left: GDP - Right: Inflation rate

Source: Bloomberg Economics

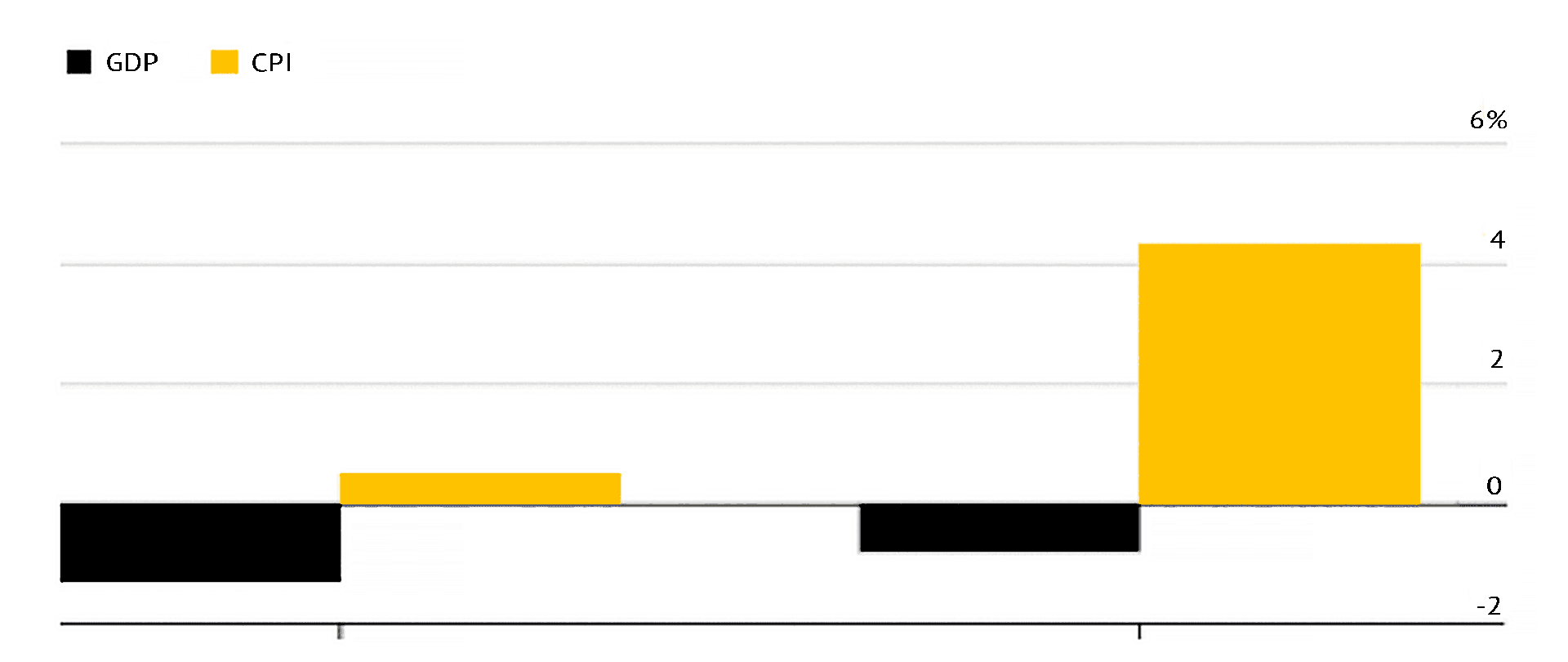

In addition, a model from the World Trade Organization suggests that if Trump's tariff plan is fully implemented, assuming only China takes retaliatory measures, GDP will decrease by 0.8% and prices will rise by 4.3% by 2028.

If other countries also take retaliatory measures, the impact will be even more severe, with GDP shrinking by 1.3% and prices only rising by 0.5%, as a decrease in exports will simultaneously slow down economic growth and inflation (Figure 2).

The escalation of the trade war will reduce US economic growth and increase prices.

Expected impact of Trump's tariff plan by 2028 (relative to baseline)

Left: If China and other countries in the world take retaliatory actions

Right picture: If China takes retaliatory actions alone

Source: Bloomberg Economics

Gold may benefit from increased trade tensions and Trump's reinflation policies.

Policy: Trump plans to impose a 20% tariff on all imported goods and a 60% tariff on Chinese goods, effectively increasing costs for consumers while protecting domestic industries. This strategy is rooted in the "America First" policy and may exacerbate geopolitical tensions and create economic uncertainty.

In addition, Trump also proposed to extend the Tax Cuts and Jobs Act, which lowers the corporate tax rate from 35% to 21% and plans to further reduce the corporate tax rate to 15% while lowering the personal income tax rate.

Impact: The combination of tax cuts and increased spending may increase disposable income and consumption, which could lead to a rebound in inflation, making gold an attractive safe haven.

In addition, Trump's aggressive stance on tariffs and trade issues may exacerbate geopolitical tensions, potentially prompting investors to turn to safe haven assets such as gold and driving up gold prices. During his presidency from 2017 to 2021, driven by the US China trade war and the pandemic, gold prices soared by over 70%. Although history may not repeat itself, it often follows patterns.

As Trump is about to return to the throne as the 47th president, the market is preparing for a huge uproar. Oil, gold, and the S&P 500 index will all experience significant volatility, and traders will face enormous opportunities. However, only those who are prepared for quick action can receive rewards.

At Exness, even amidst the volatility caused by Trump, you can enjoy unparalleled spreads. Whether you are trading gold, oil, or US related assets, our platform can provide you with unparalleled conditions, allowing you to trade with peace of mind. No transaction fees, fast execution, and 24/7 customer service support - in the rapidly changing market under the Trump administration, we will provide you with everything you need to maintain a leading position.

The question is not whether Trump will affect the market, but how significant the impact will be. Don't wait until it's too late to take action. Trade the Trump Effect on the Exness platform - Join the ranks of over 800000 traders and make the most of this historic moment.