It is expected that volatility will intensify during the US election period, while creating potential trading opportunities. According to opinion polls, the presidential and Senate voting results may be evenly matched, so uncertainty is likely to cause significant turbulence before and after the election. How will the election situation affect the market? See what our expert analysts have to say:

In 2020, despite Biden leading in most polls, Trump's enthusiasm for posting tweets, expressing opinions on democracy and elections, spreading rumors of election fraud, and actively interacting with supporters sparked market volatility, leading to greater volatility in financial assets compared to 2012 and 2016. Will 2024 repeat history?

Whether it's Trump from the Republican Party or Harris from the Democratic Party winning, here are our analysts' views on how key markets will respond to potential presidential election policies.

DXYOr respond to the trade protection stance and potential tariffs against China, accompanied by the return of the "strong dollar" policy.

goldBusiness friendly policies and tax exemptions can promote growth and reduce demand for safe haven assets such as gold.

crudeMeasures to support crude oil production or increase supply are expected to lower crude oil prices.

Nazhi 100Trade policies may trigger volatility, but tech giants may benefit from relaxed regulations and tax reductions.

DXYHarris' multilateral trade measures may bring stability to the US dollar.

goldAn increase in public spending, tightening of regulations, or depreciation of the US dollar are favorable for gold prices.

crudeEnvironmental protection regulations or restrictions on crude oil supply will raise oil prices in the long run.

Nazhi 100Enterprise taxation increases, regulation intensifies or suppresses the market in the short term.

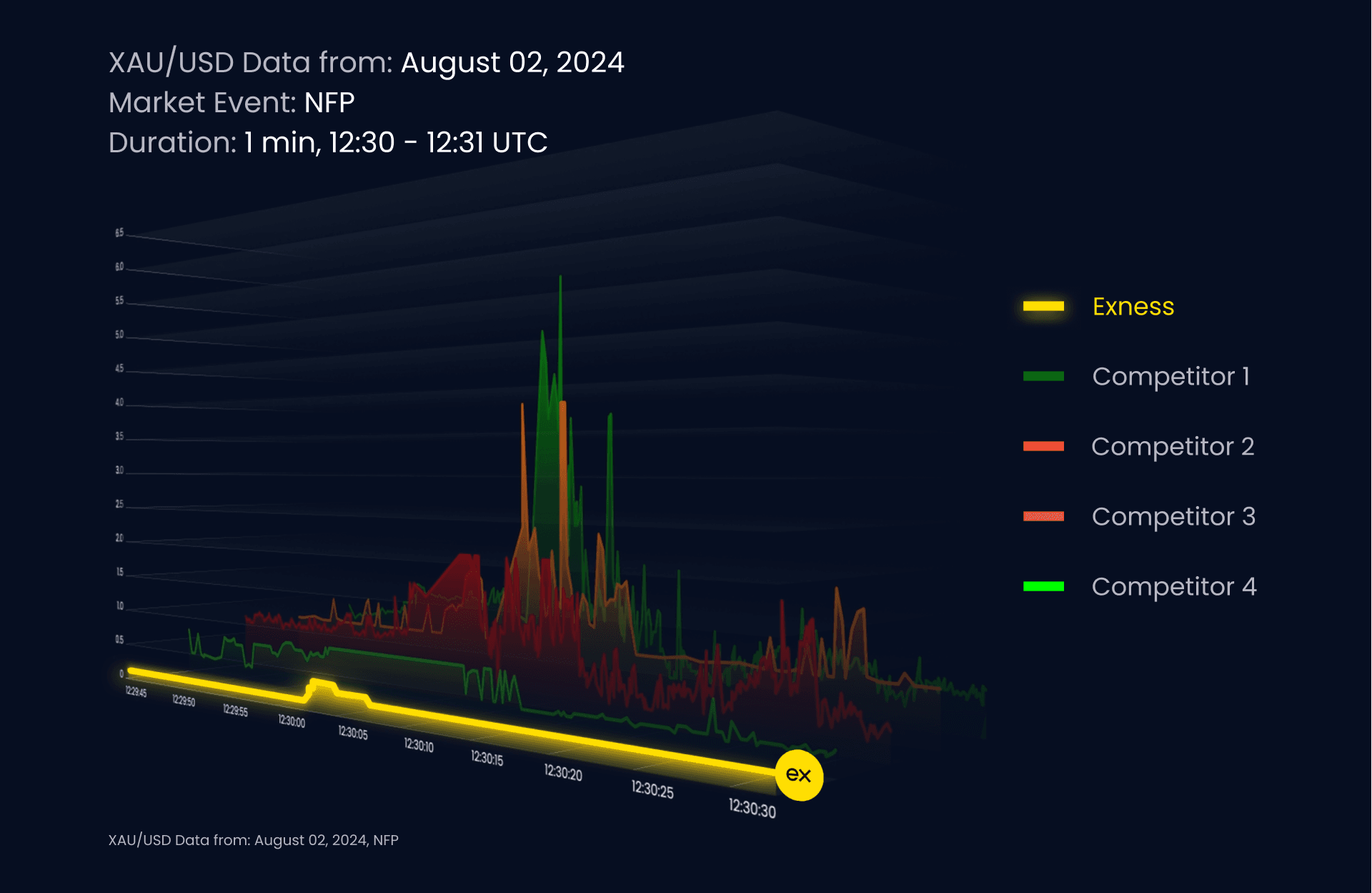

Our proprietary pricing algorithm uses real-time volatility to generate low, stable spreads.

During major news releases, the spreads of other brokers often experience significant fluctuations. Compared to them, although our spreads are also affected, they remain low and more stable throughout the entire release period.

*Spreads may fluctuate or widen due to market fluctuations, news releases, economic events, opening and closing times, and trading varieties.

Source: Exness Financial Market Research Laboratory, independently collected data and calculated by us.

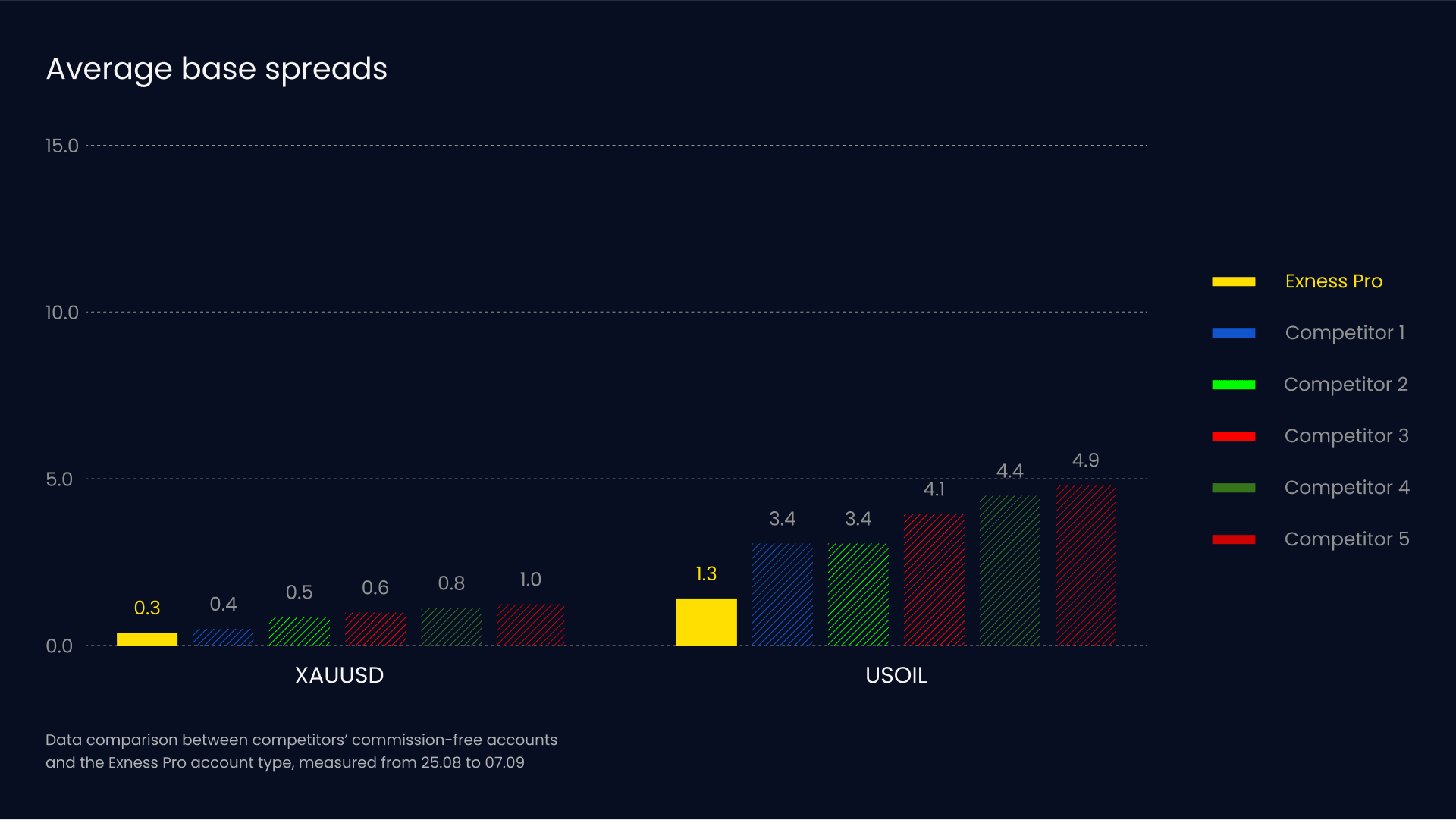

Seize the opportunity to trade in the US presidential election by leveraging the best market spreads. without doubt.

Comparison of data between competitors' fee free accounts and Exness' pioneer account types from August 25th to September 7th.

The market volatility related to the election situation will bring valuable trading opportunities. Mastering the impact of policies can help you cope with uncertainty in elections. Exness providing the lowest and most stable spreads means that the platform is the best choice during the election period.

This is not investment advice. Past performance does not represent future performance. Your funds are at risk, please trade with caution and responsibility.