Intel has successfully identified AWS as its primary customer for foundry services, marking a significant victory in reclaiming the market dominated by TSMC. Industry analysts point out that Intel has shown positive momentum in winning OEM orders. Winning AWS not only adds a new customer, but also strongly affirms Intel's ability to manufacture chips for external enterprises, further strengthening its position in the fiercely competitive OEM field.

But Intel's ambition seems to be more than just building partnerships. Various signs indicate that the company is preparing to split into two independent entities: one focused on core chip design and manufacturing, and the other focused on foundry services. This potential spin off suggests that Intel is undergoing strategic adjustments aimed at optimizing operations while eliminating potential customers' concerns about competition and conflicts of interest.

The logic behind establishing an independent OEM subsidiary is very intriguing. This measure is equivalent to establishing a reasonable "firewall" and "protection mechanism" for Intel's foundry business. This spin off will give other customers peace of mind, ensuring they have exclusive production capacity and wafer allocation, making Intel's services more attractive to large customers who require significant resources.

While Intel is driving this strategic transformation, the company has also gained attention for a series of significant developments. On September 16th, Intel received up to $3 billion in direct funding support under the framework of the Chip and Science Act for the Secure Enclave project. The project aims to expand Intel's trusted production capacity to manufacture advanced semiconductors for the US government, enhance national security and technological capabilities - this measure highlights Intel's determination to strengthen its domestic chip manufacturing in the United States against the backdrop of increasingly severe global supply chain issues.

Earlier this month, Intel released a new Core Ultra processor, marking a significant breakthrough in performance and efficiency for entering the AI era. These processors not only perform better in artificial intelligence task processing, but also significantly improve graphics performance and energy efficiency, giving Intel a leading position in the constantly evolving computing field.

Intel CEO Ben Bajarin has made multiple public statements during the company's transformation process. Recently, he emphasized the strong growth momentum of Intel's foundry business in a speech to employees, particularly mentioning the cooperation agreement with AWS and other recent successful cases. He also emphasized that the company is actively implementing cost cutting measures and reiterated Intel's commitment to expanding global production capacity to meet market demand. In addition, the convening of a highly effective and supportive board meeting further demonstrates the company's confidence in its strategic direction.

Although the specific details of this collaboration have not been disclosed, this multi billion dollar framework agreement indicates that it may have a profound impact on Intel's revenue and profitability in the coming years. Currently, investors may be carefully evaluating these new trends.

Can this cooperation enhance market confidence in Intel's transformation efforts and drive its stock price up?

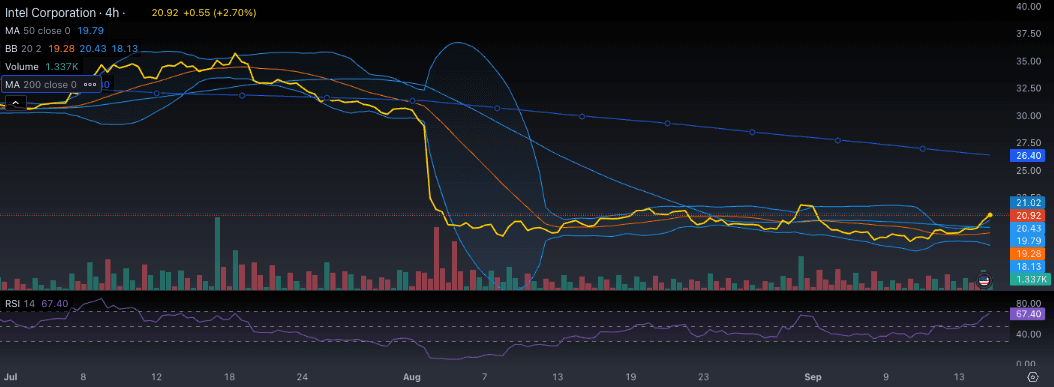

Intel's current market performance is mixed. According to the latest data, the stock is currently trading at $20.31, with a 52 week high of $51.28 and a low of $18.51.

Technical indicators indicate that the stock price is showing an upward trend in the short term, but the overbought phenomenon suggests that there may be a pullback. The Relative Strength Index (RSI) is 70.86, which usually indicates that the asset is in an overbought state. The moving average shows a bullish outlook in the short to medium term, but the 200 day moving average is higher than the current price, indicating that bearish sentiment still exists in the long term.

For traders, this may be a signal to consider taking profits or tightening stop loss orders for existing positions. For investors, they may need to be more cautious, perhaps considering establishing new positions after the stock price clearly breaks through the 200 day moving average or rebounds to support levels. In the coming months, the market's response to Intel's strategic initiatives will be crucial.

In the long run, the long-term impact of Intel's partnership with AWS is far-reaching. Can this collaboration accelerate innovation in the AI field and promote the implementation of more powerful and efficient AI models and applications? Will it consolidate the leading position of the US semiconductor industry in the current context of technological competition between China and the United States? More importantly, will Intel's strategy of transforming into an independent manufacturing subsidiary set a new benchmark in the industry and drive other companies to follow suit?

As Intel enters this critical period of transformation, there is no doubt that the success or failure of this journey is crucial, and the entire industry is closely monitoring it. Whether Intel can successfully achieve its strategic vision will determine its future and may even reshape the semiconductor industry. Investors, competitors, and technology enthusiasts are all closely monitoring the relevant trends.